Turning MGAs into InsurTechs

Lorem Ipsum dolar

sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

ChainThat Partners With MGAs

Our all-in-one platform offers a wide range of features to address your needs. It covers everything from handling distribution, products, and underwriting guidelines to managing reinsurance agreements and invoicing. The system also provides robust reporting tools, document control, and customer relationship tracking. For Managing General Agents, Underwriting Agencies and Underwriting Agents, our integrated solution simplifies and enhances both day-to-day tasks and overall business oversight.

ChainThat helps MGAs launch new products in 6-8 weeks using configurable templates, an AI-powered configuration assistant, pre-built integration tools and automated workflows.

Designed to adapt to your needs and offering extensive configuration options, ChainThat’s platforms are built to accommodate the distinct operational demands of MGAs, Underwriting Agencies, and Program Administrators while staying responsive to shifting market trends. Our team of specialists collaborates with you to optimize workflows, guaranteeing smooth implementation and operational excellence. The platform empowers MGAs with a high degree of autonomy, allowing self-service implementation and deployment of modifications as needed.

ChainThat’s platforms are engineered to integrate seamlessly with other systems, allowing MGAs to easily exchange data with external data providers and stakeholders. With self-service Power BI embedded reporting capability, our platforms also support Lloyds’ Coverholder requirements. They can also easily operate in headless mode allowing brokers to connect from their platforms performing straight-through processing with secure APIs.

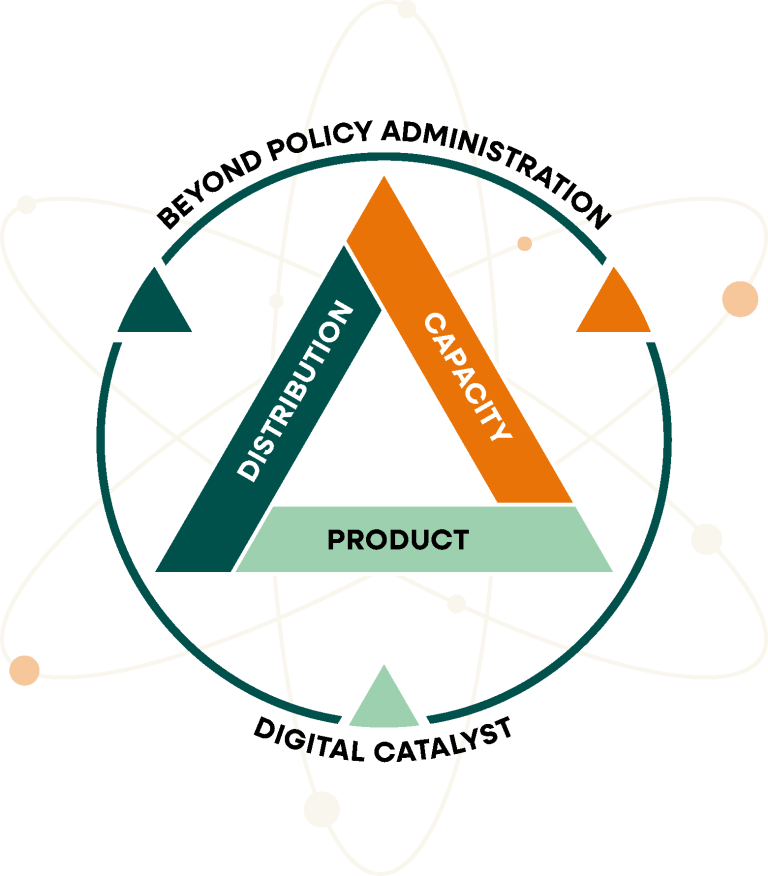

ChainThat’s Beyond Policy Administration Platform acts as a digital catalyst for MGAs / agencies by fusing together product, distribution and capacity.

Operational Efficiency

Straight through processing, self-service configurability enables lower TCO overall.

Agile by Design

Efficient adaptation to new market demands and regulatory requirements.

Business Growth Support

Faster Speed-To-Market with quick product launches, and the ability to diversify into new product lines efficiently.

Strengthen Carrier Partnerships

Automation of underwriting guidelines; real-time reporting and binder performance.

Lloyd's Coverholder Compliance

Lloyd's v5.2 support ensures compliance and accurate, timely reporting of risks and premiums.

Your Key Benefits

Your Key Benefits

Secure.

Efficient.

Scalable.

The Tech

Empower your MGA with our next-gen platform

Beyond Policy Administration

Market-leading policy administration that adapts to the evolving needs of the market. Support custom or bureau/ISO product lines while supporting underwriting guidelines.

BPA is more than a platform—it’s a digital catalyst. Built by insurance technology experts, it fuses product, distribution, and capacity into a single, powerful ecosystem. With self-service configuration, modular architecture, and built-in data capabilities, BPA empowers MGAs to launch products faster, respond quickly to market changes, and stay agile in an evolving landscape.

Cyber Insurance – A Digital Revolution

Comprehensive feature set