Beyond Policy Administration

Introducing Beyond Policy Administration (BPA) – our next-generation policy administration platform. A digital catalyst for growth, BPA fuses together product, distribution and capacity to help your business flourish. BPA provides customizable templates, intuitive rule-setting, and data-driven insights to save time and boost profitability.

Beyond Policy Administration

Introducing Beyond Policy Administration (BPA) – our next-generation policy administration platform. A digital catalyst for growth, BPA fuses together product, distribution and capacity to help your business flourish. BPA provides customizable templates, intuitive rule-setting, and data-driven insights to save time and boost profitability.

A True Partner

We Go Beyond

By deploying BPA, insurers and MGAs gain simplicity and efficiency,

as well as the ability to quickly and smoothly launch new products and

adapt to new requirements as their businesses grow.

Lorem Ipsum dolar

sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Master Insurance Agility

In Numbers

8-10

to launch a new product with BPA.

4

migrate 50K policy records.

30+

Pre-built out-of-the-box connectors.

~25%

Faster configuration with BPA’s chatbot.

Functional Capabilities

What Beyond Policy Administration delivers – in detail.

- Product Configuration

- Underwriting & Rating

- Policy lifecycle servicing

- Reporting & Integration

- Forms & Billing

- Forms & Billing

Product Configuration

Product set-up

Configure Insurance Product: Product structure, underwriting rules, forms, portals, notifications multi-carrier support, multi-currency support, broker management, commission handling, AI-assisted configuration, taxes and regulatory compliance. Verified by Kentucky Department of Insurance for handling taxes

Self-service configuration

BPA’s no-code configuration tool means that insurers are able to establish their system on their own. The Gen AI-assisted configuration helper empowers insurers to autonomously customize and deploy insurance products through an intuitive, conversational interface

Product Versioning

BPA maintains a comprehensive version control system for all insurance products with configurable approval process of product roll outs, ensuring traceability and auditability throughout the product lifecycle.

Product Templates

Pre-configured accelerators, containing common policy structures, coverages, and rules that can be rapidly customized for new product launches across different lines of business or geographical regions, promoting operational efficiency

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Underwriting / Rating

Automate Underwriting Rules

Predefined decision-making configurations that evaluate insurance applications based on specific criteria, enabling faster and more consistent risk assessment. Such automated UW rules can be easily updated to reflect changes in underwriting guidelines, market conditions, or regulatory requirements, ensuring agility in product management.

Rating engine

Inbuilt rating engine that can handle multi-section, multi-product rating for bundled offerings. With drag-drop capability & rule based configuration, it allows rating administrators to define, modify and manage rating rules with multiple versions with specific effective dates. Gain greater control and visibility with BPA’s built-in rating engine equipped with configurable rate tables and version control.

Work with external rater

BPA can seamlessly integrate with external rating services through APIs, allowing insurers to leverage standardized, up-to-date rating content and algorithms within their existing workflows, enhancing pricing accuracy and operational efficiency. It can integrate with Verisk’s ISO RaaS (Rating as a Service).

Audit history / versions

Obtain greater transparency with dynamically generated rating worksheet and maintain detailed logs of all rating calculations, supporting transparency, debugging, and regulatory compliance.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Policy Lifecycle

End-to-end policy servicing

BPA systems provide comprehensive support for the entire policy lifecycle, from quoting and issuance through renewals and cancellations, binder management, while accommodating out-of-sequence endorsements to ensure accurate policy servicing and maintain historical integrity.

Flexible Workflows

BPA systems orchestrate comprehensive underwriting workflows, automating risk assessment, decision-making and approval processes from initial application through policy issuance and post-bind transactions. Dynamic OFAC check can be integrated at different points in the workflow.

Task Management

BPA platforms offer robust task management capabilities, including automated and manual task creation, allocation to individuals or groups, SLA tracking and escalation, and flexible workflow design to support diverse business processes and operational efficiency.

Insurer/Broker/Insured Portals

BPA offers intuitive, drag-and-drop tools for rapidly building user-friendly portals tailored to underwriters, brokers, and insureds, enabling easy customisation of look-and-feel, user journeys, and functionalities.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

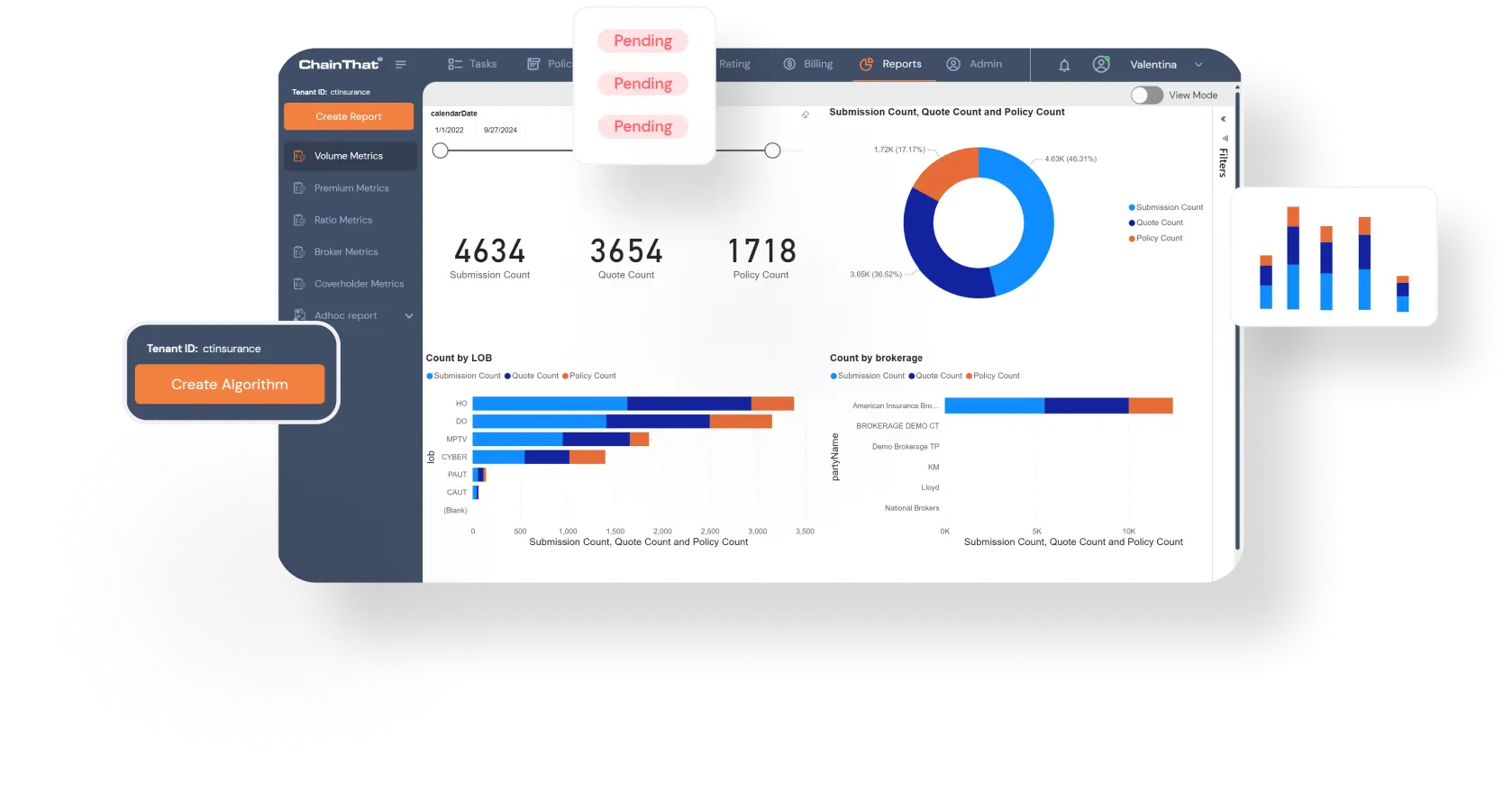

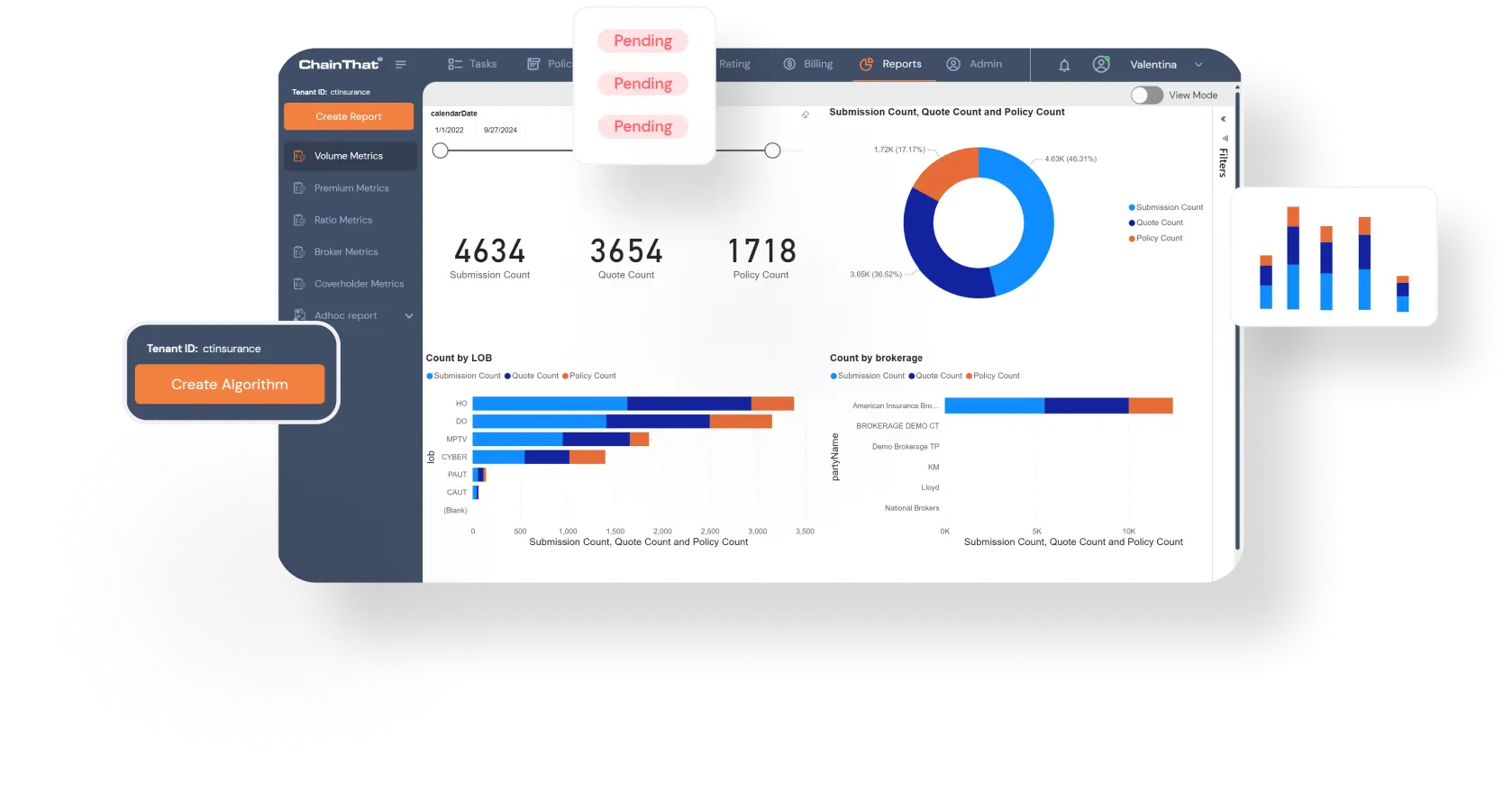

Reporting / Integration

Embedded Analytics

Ensure transparency and monitor business performance accurately with real-time reporting and business intelligence tools in BPA. Supports Lloyds’ 5.2 Borderaux report for coverholders.

Role Based Access Control

Working on role-based access rules as standard, BPA adds an extra layer of security with SSO and multi-factor authentication tools. BPA has robust Role Based Access Control to configure fine grained user authorisations on the platform.

Data Connectors

BPA comes with more than 30 pre-built out-of-the-box connectors that seamlessly integrate with various data sources and third-party systems. BPA can easily connect with heterogeneous systems with various integration protocols (SOAP, REST, Webhook etc.)

Headless architecture

BPA platforms leverage headless architecture to provide flexible, API-driven integration capabilities, enabling seamless connection with diverse third-party systems while maintaining a robust, scalable core that supports omnichannel experiences. BPA publishes all its APIs as Open API specifications.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Billing & Forms

Payment Plans & Billing Options

Supports both direct and agency billing and ability to set-up and manage different payment plans and flexible commission handling. Configure the options based on the needs of the insurer.

Cash Reconciliation

Cash Reconciliation Plugin helps insurers and MGAs automate broker remittance, internal policy records, and cash reconciliation between bank statements. Insurance organizations can extract remittances in PDF format and match them with broker accounts to verify policy and accounts receivable details

Forms/Document Management

BPA systems offer comprehensive form management and document handling, featuring static/dynamic form generation, intelligent data capture, version control, and automated document routing, while supporting digital signatures and integration with content management systems for streamlined paperless operations. Supports ISO and AAIS form too.

Flexibility & agility

Multi-carrier, multi-currency operations easily supported in BPA. ChainThat also provides effective and efficient version management support.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Billing & Forms

Payment Plans & Billing Options

Supports both direct and agency billing and ability to set-up and manage different payment plans and flexible commission handling. Configure the options based on the needs of the insurer.

Cash Reconciliation

Cash Reconciliation Plugin helps insurers and MGAs automate broker remittance, internal policy records, and cash reconciliation between bank statements. Insurance organizations can extract remittances in PDF format and match them with broker accounts to verify policy and accounts receivable details

Forms/Document Management

BPA systems offer comprehensive form management and document handling, featuring static/dynamic form generation, intelligent data capture, version control, and automated document routing, while supporting digital signatures and integration with content management systems for streamlined paperless operations. Supports ISO and AAIS form too.

Flexibility & agility

Multi-carrier, multi-currency operations easily supported in BPA. ChainThat also provides effective and efficient version management support.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

The Tech

Product Architecture

ChainThat’s Beyond Policy Administration Platform technology architecture leverages cloud-native container technology and a SaaS model with robust security, API-driven integration, and flexible access to ensure scalability, seamless integration, and comprehensive business insights.

Cloud-native and containerized

Utilizes cloud container technology for scalable and efficient deployment.

API-first and integration friendly

Designed with an API-first approach, BPA ensures seamless integration with various systems.

Microservices architecture

Supports a flexible and modular microservices architecture for enhanced scalability and maintenance.

Multi-tenancy support

Accommodates multiple tenants with data isolation and efficient resource usage.

Secure and compliant

Ensures data security with encryption at rest and in motion, adhering to the strictest compliance standards.

Automation and event-driven

Features automation testing capabilities and is built on an event-driven architecture for real-time processing.

Lorem Ipsum Dolor Sit

Consectetur Adipiscing

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do

eiusmod tempor incididunt ut labore et dolore magna aliqua.

Lorem Ipsum dolar

sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.llorum snsjjs sjsjs snjsjs sjsj ssj iewiene eied dssj sshss shshns shss ssjhjsjss sjssiwsww wjeiejehejeesd siwiwiwjwjw sueie dsj sjssj.

Lorem Ipsum dolar

sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.llorum snsjjs sjsjs snjsjs sjsj ssj iewiene eied dssj sshss shshns shss ssjhjsjss sjssiwsww wjeiejehejeesd siwiwiwjwjw sueie dsj sjssj.