Beyond Policy Administration

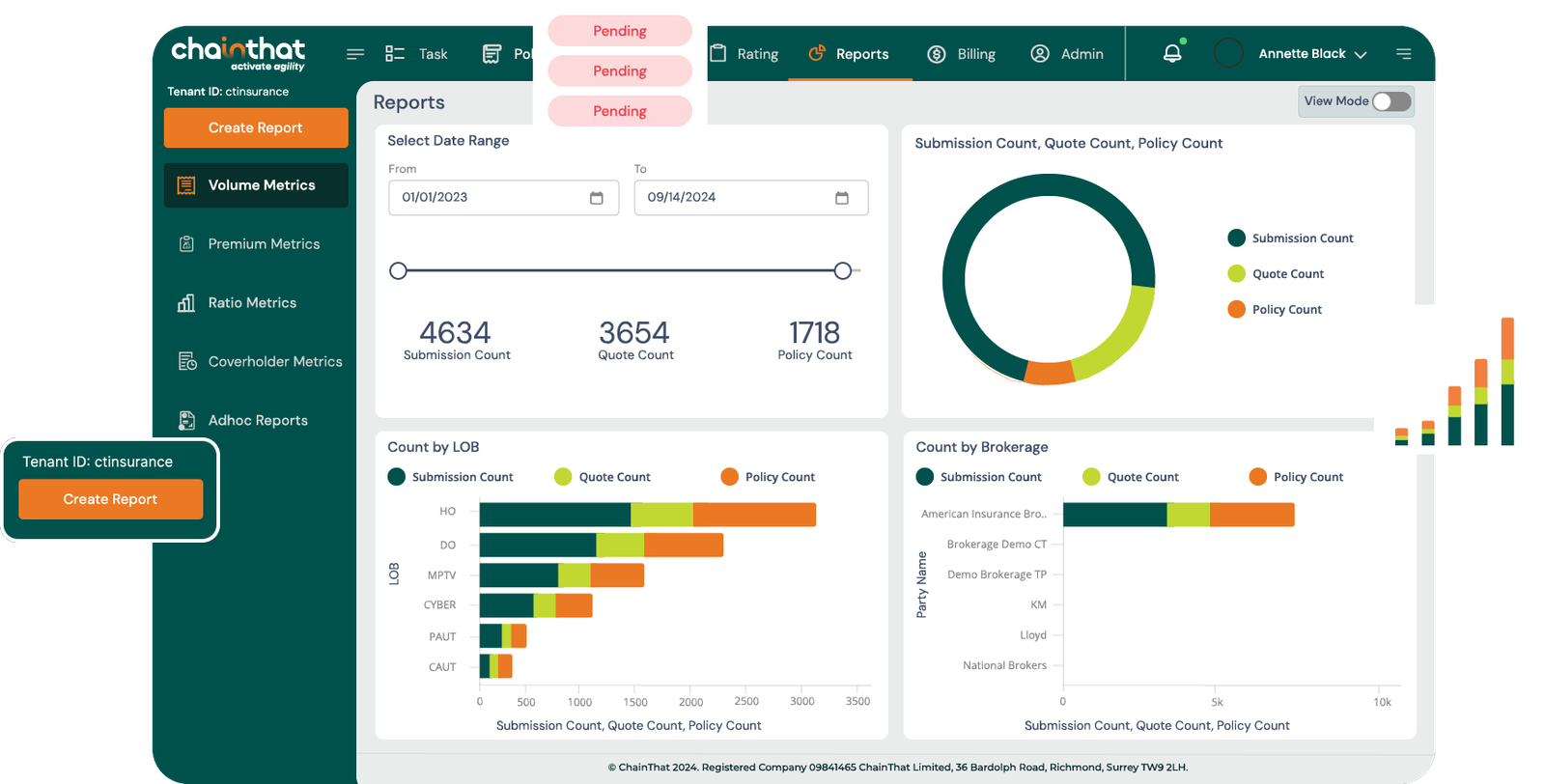

Beyond Policy Administration (BPA) is our next-generation policy administration platform. A digital catalyst for growth, BPA fuses together product, distribution and capacity to help your business flourish. BPA provides customisable templates, flexible rule engine, configurable workflows and data-driven insights to save time and boost profitability.

We Go Beyond

Our very first platform – BPA – is more than your average policy administration platform. By deploying BPA, insurers and MGAs gain simplicity and efficiency, as well as the ability to quickly and smoothly launch new products and adapt to new requirements as their businesses grow.

Master Insurance Agility

Fast & Flexible

Simplifies Underwriting

Customizable & Scalable

Connectivity

Governance

8-10

Average number of weeks it takes to launch a new product with BPA.

4

Number of hours it takes to migrate 50K policy records.

30+

Pre-built data connectors.

~25%

Efficiency gained with BPA’s GEN AI-assisted configuration.

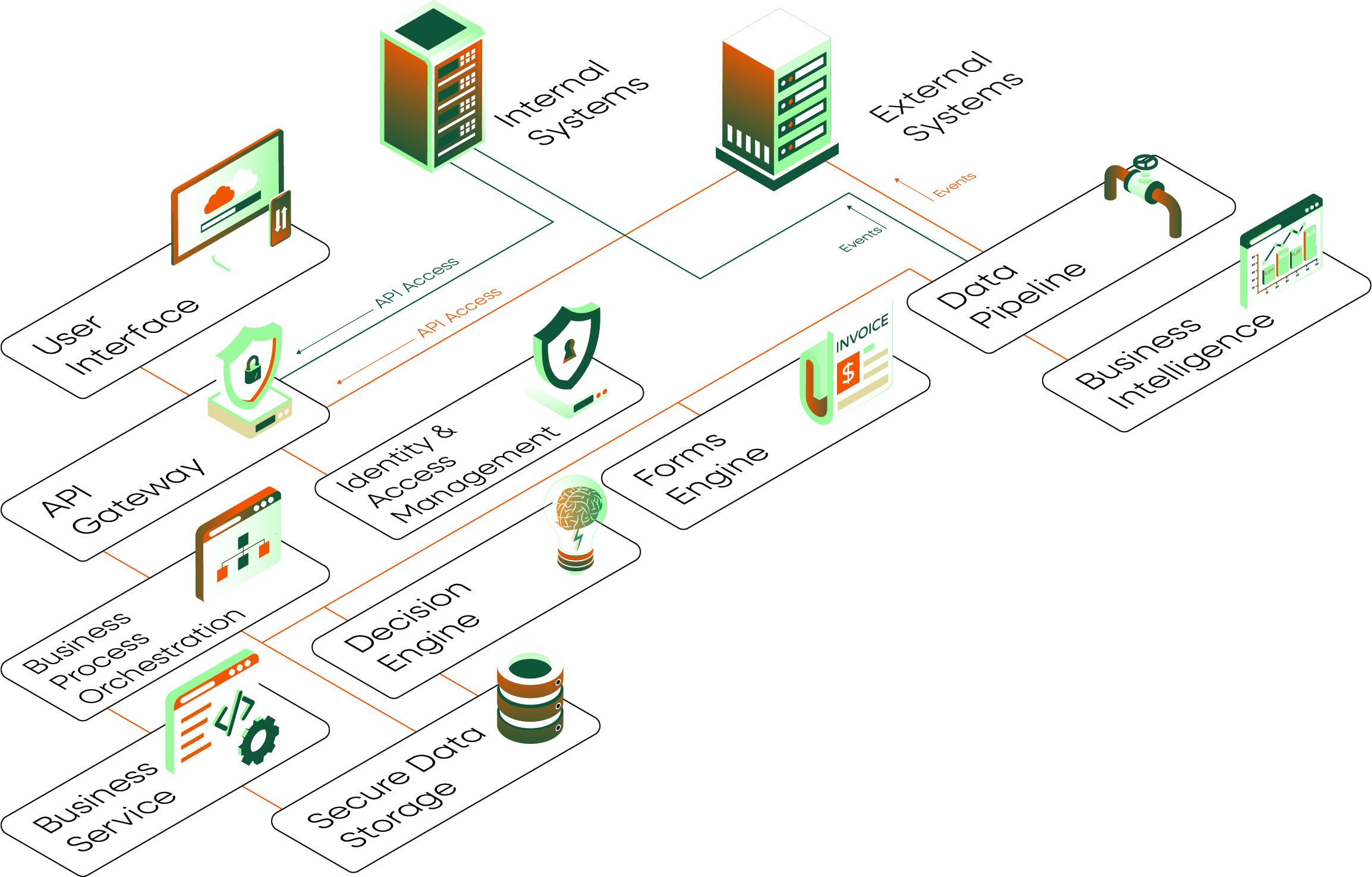

Product Architecture

ChainThat's Beyond Policy Administration Platform technology architecture leverages cloud-native container technology and a SaaS model with robust security, API-driven integration, and flexible access to ensure scalability, seamless integration, and comprehensive business insights.

-

Cloud-native and containerized

Utilizes cloud container technology for scalable and efficient deployment.

-

API-first and integration friendly

Designed with an API-first approach, BPA ensures seamless integration with various systems.

-

Microservices architecture

Supports a flexible and modular microservices architecture for enhanced scalability and maintenance.

-

Multi-tenancy support

Accommodates multiple tenants with data isolation and efficient resource usage.

-

Secure and compliant

Ensures data security with encryption at rest and in motion, adhering to the strictest compliance standards.

-

Automation and event-driven

Features automation testing capabilities and is built on an event-driven architecture for real-time processing.

Working with ChainThat

We have a clear purpose at ChainThat to develop technology platforms that activate agility in insurance organisations, enabling them to realise their full business potential. Our dedicated team work hard to help our clients drive their competitive advantage and gain market share.

Cyber Insurance – A Digital Revolution

“Enhancing operational efficiency and supporting scalable growth for an MGA that specializes in innovative cyber insurance products. Objectives included integrating advanced logic into workflows and enhancing process automation, reducing manual errors and facilitating seamless collaboration with a diverse range of partners.“. – Mike Cavanaugh, CUO of Fusion

Cyber Insurance – A Digital Revolution

“Enhancing operational efficiency and supporting scalable growth for an MGA that specializes in innovative cyber insurance products. Objectives included integrating advanced logic into workflows and enhancing process automation, reducing manual errors and facilitating seamless collaboration with a diverse range of partners.“. – Mike Cavanaugh, CUO of Fusion

Amparo Embraces Digital Capabilities Through ChainThat

“Amparo’s mission has always been to provide fair and accessible auto insurance to the immigrant community. Partnering with ChainThat allows us to leverage advanced technology to serve our customers better and streamline our processes.” – Pushan Sen Gupta Co-Founder of Amparo Insurance

Amparo Embraces Digital Capabilities Through ChainThat

“Amparo’s mission has always been to provide fair and accessible auto insurance to the immigrant community. Partnering with ChainThat allows us to leverage advanced technology to serve our customers better and streamline our processes.” – Pushan Sen Gupta Co-Founder of Amparo Insurance