Beyond Insurance Accounting

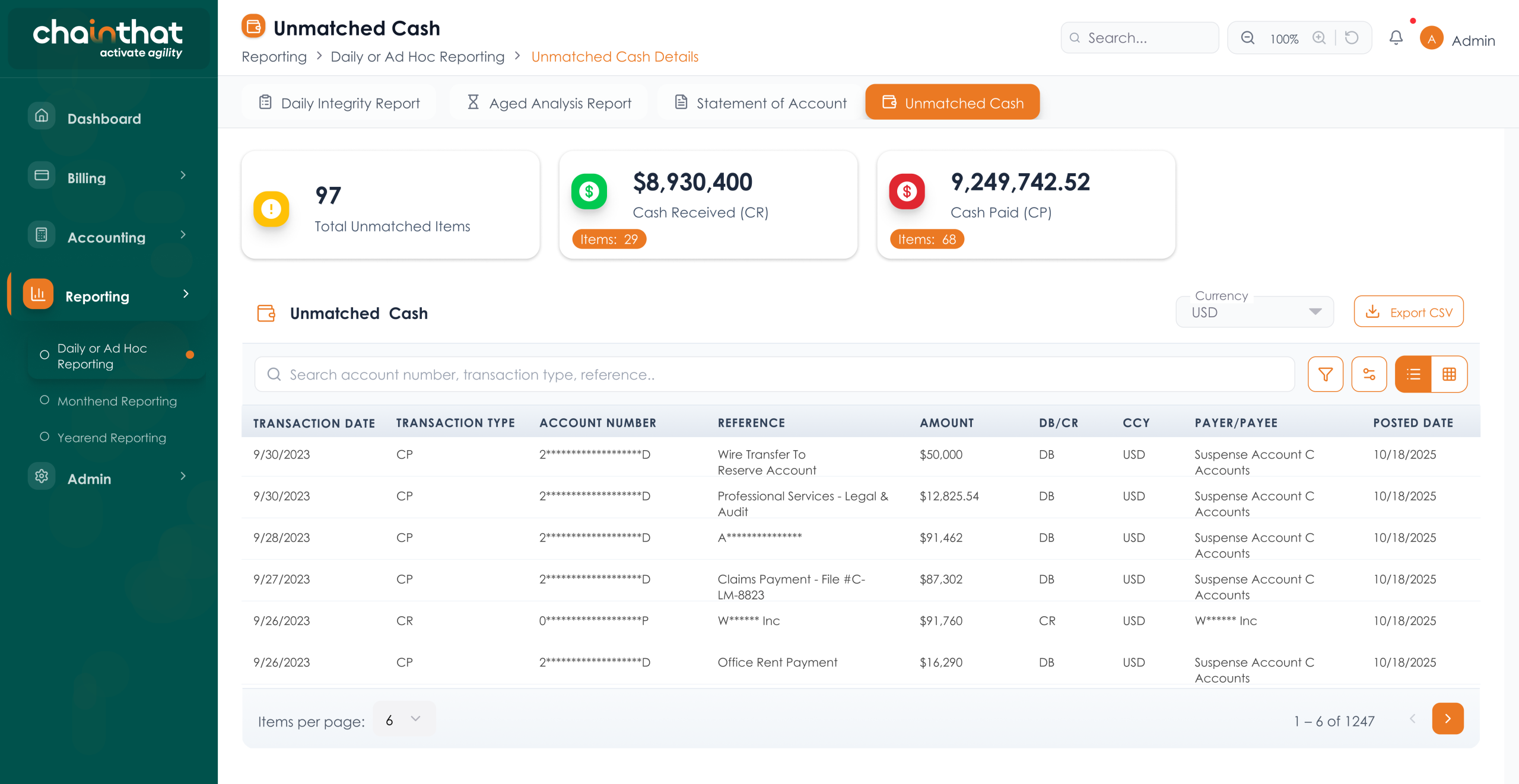

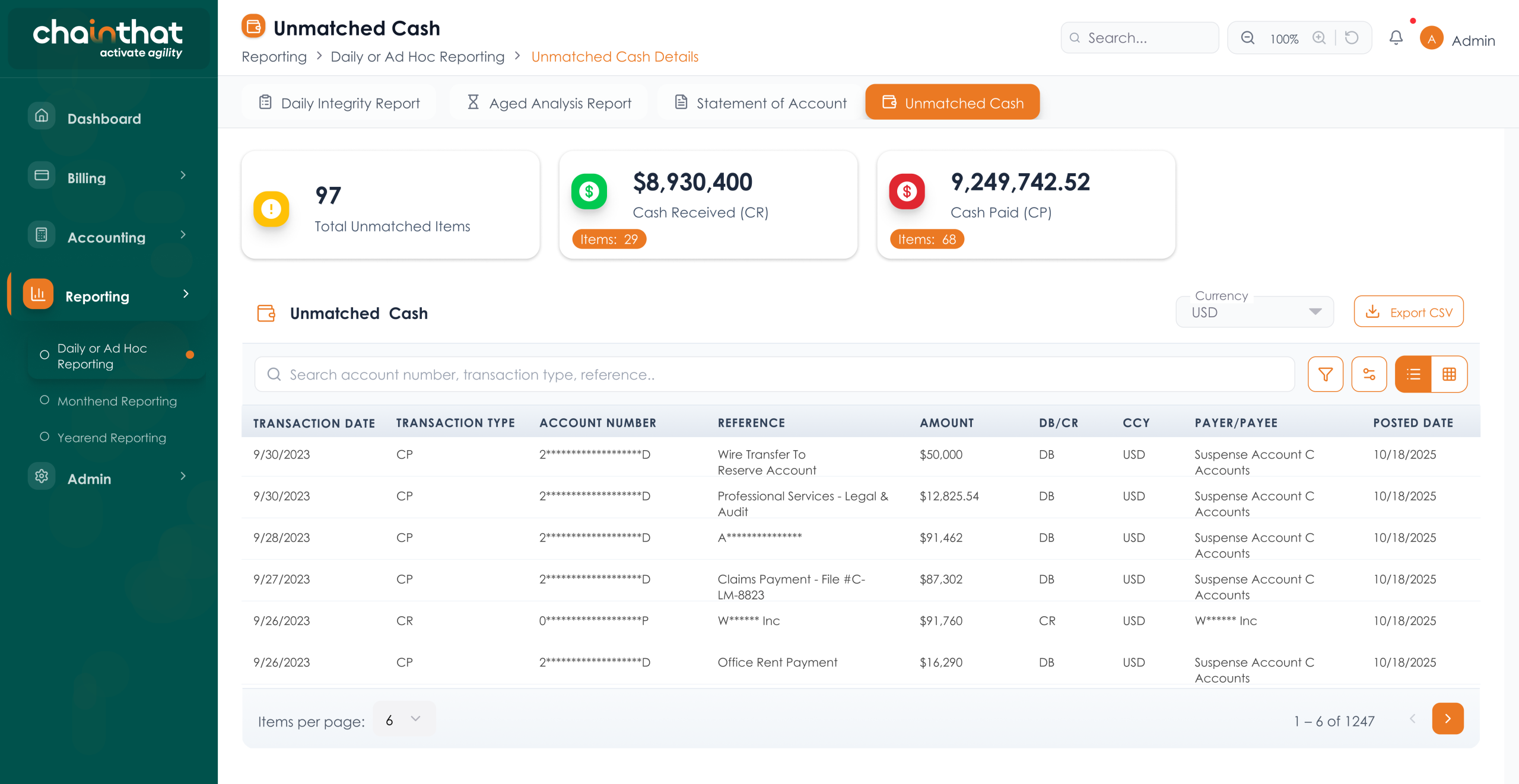

Beyond Insurance Accounting (BIA) redefines the financial operations landscape with an industry-specific accounting platform that unifies billing, payments, and accounting into a compliant, automated solution. Built to deliver real-time control, strategic insights, and scalability, BIA empowers insurance organisations like MGAs, agencies, carriers, and brokers to operate with precision and confidence in an ever-evolving market.

We Go Beyond

Our newest platform – BIA – revolutionises insurance accounting by automating the source-to-ledger process. With AI-powered data ingestion, low-code rule mapping, and automated reconciliation workflows, BIA provides accurate, audit-ready financials in real time. This next-generation cloud-native platform offers CFOs and finance leaders the ability to pivot from reactive reporting to strategic decision-making, all while maintaining compliance and minimising operational overhead.