Seamless Rating Engine Integration: How ChainThat Integrated Finrater into BPA

When we wanted to enhance our Beyond Policy Administration (BPA) platform’s rating capabilities for our Australian clients, we knew we needed a partner who shared our vision for simplified, powerful insurance solutions. Our collaboration with Finity and their Finrater product has achieved exactly that — delivering a seamless integration that’s transforming how our clients handle policy rating.

“We know the appetite for a tool such as Finrater is high, but insurers can sometimes shy away from the cost and effort involved with integrating new tools.”

— Nikolay Nikolaev, Finrater Solution Architect, Finity

Finrater at a Glance

Finrater, developed by Finity, is a sophisticated pricing and underwriting engine built specifically for the insurance sector. What sets it apart is its ability to:

• Provide fast and accurate premium calculations

• Offer easy implementation processes

• Connect seamlessly with core insurance systems

• Enable quick deployment of pricing changes

• Support complex pricing algorithms

The Need for Seamless Integration

Insurance pricing models can be highly complex, requiring precise calculations to determine competitive premiums. While many rating engines exist, they often demand significant IT support, long implementation cycles, and costly integration efforts.

Finrater is different. It’s fast, adaptable, and easy to integrate — making it a natural fit for our BPA platform, especially for insurers and Lloyd’s coverholders looking for modular, ecosystem-ready solutions.

ChainThat x Finity: A Strategic Partnership

Our collaboration with Finity was driven by a shared goal: to create a flexible, scalable, and efficient solution that allows insurers and MGAs to modernise their pricing capabilities — without heavy technical overhead.

“By teaming up with Finity and integrating Finrater into our BPA platform, we’re enabling underwriting agencies to handle policy rating with greater speed, accuracy and confidence. This partnership is another step forward in ChainThat’s mission to deliver interoperable, ecosystem-ready insurance solutions.”

— Vikas Acharya, CEO, ChainThat

ChainThat and Finity were able to integrate their systems seamlessly and quickly, unblocking value for our customers and setting the foundation for future integrations.

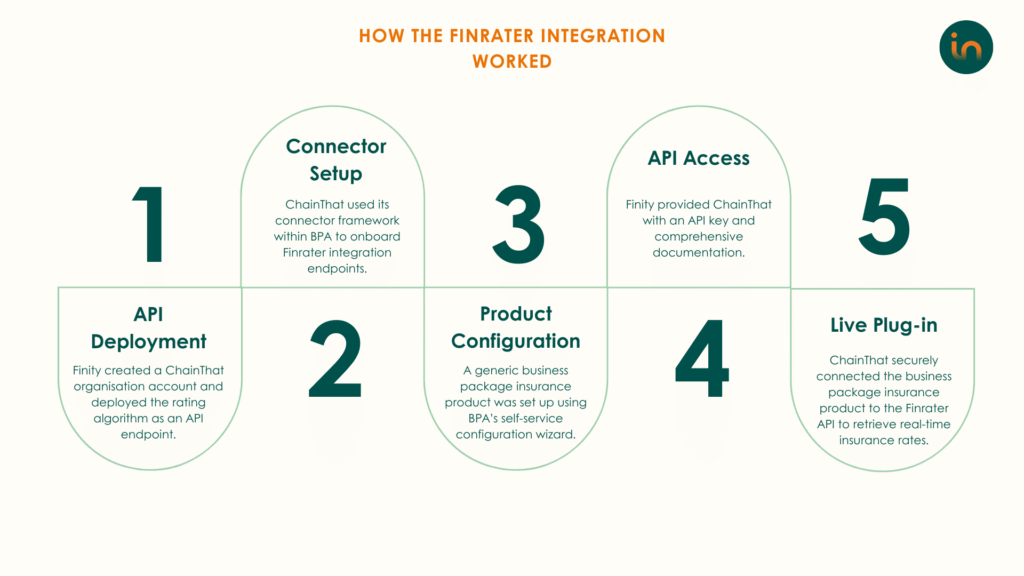

How the Integration Worked

Thanks to a robust architecture on both sides, the BPA–Finrater integration was completed in under a day. Here’s how it came together:

The Result

Integrations like this are made easy when both systems are built for interoperability. The entire process took less than a day, and the module is now reusable — allowing other BPA clients to activate Finrater with minimal effort.

This is what modern insurance architecture should look like — modular, compliant, and fast.

As a Lloyd’s-compliant platform, BPA is already trusted by carriers and MGAs operating in regulated markets. With Finrater embedded, Lloyd’s coverholders now have a compliant, actuarial-grade rating engine built in — ready to support:

• Delegated authority requirements

• Rapid pricing model changes

• Scalable digital product delivery

Download the case study

Want a deeper look into the process and results? Click here to download!