Insurance Policy Lifecycle Migration: How ChainThat Simplifies the Journey

According to Gartner, as cited by Forbes, 83% of data migration projects either fail or exceed their budgets and schedules. For insurance organisations, that statistic translates into real risk—costly delays, compliance issues, and disruption to policyholders.

Migration doesn’t have to be this way. At ChainThat, we provide a smarter alternative. Our policy lifecycle migration framework is designed specifically for the insurance industry—business-friendly, agile, and built on Azure Data Factory (ADF) to deliver results quickly, reliably, and with minimal disruption.

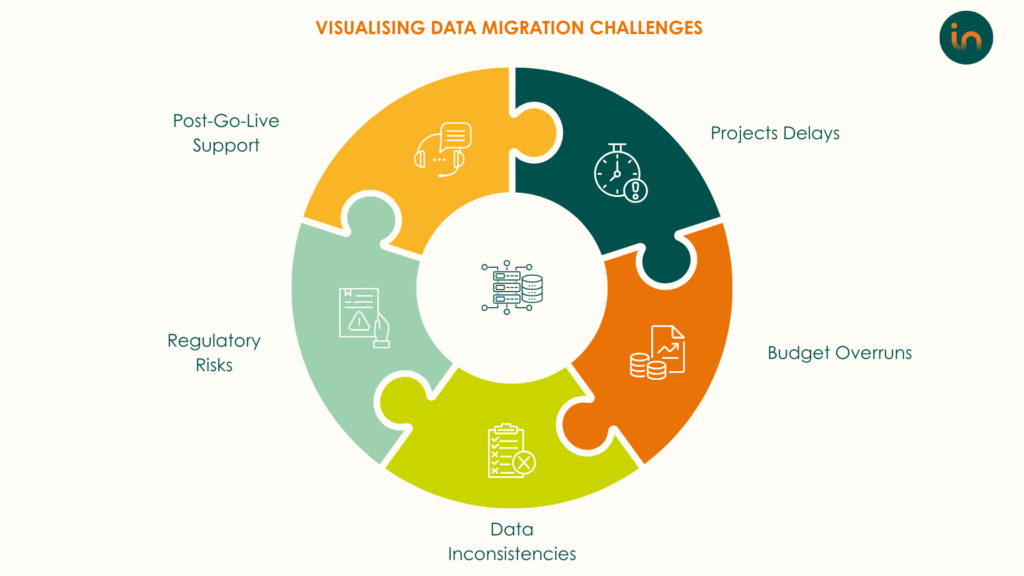

The Challenge: Why Do System Conversions / Migrations Fail?

Migration is one of the most underestimated challenges in insurance IT modernisation. A further study conducted by Forbes shows that only:

- 36% of data migration projects stay within budget

- 46% are delivered on time

For insurance leaders, CXOs, and Operations teams across organisations—these challenges always raise critical concerns:

| Concern | Category |

| Will the migrated policy data be secure, accurate & complete? | Data Security, Accuracy & Integrity |

| How will my upcoming policy renewals and endorsements work? | Customer experience/ Operations |

| Will new Rate filing (regulatory requirement in US states) will be a big pain post migration? | Regulatory Compliance |

| How can I integrate a new policy product while seamlessly transforming existing product(s) data? | Transformation to new Policy Products |

| How can I transition between Insurance standards while ensuring a smooth data migration, (e.g. moving from AAIS standards to Verisk standard)? | Switch between Insurance Standards |

| How will insurance business operations be impacted during migration | Business Impact |

| How can compliance with GDPR, IFRS 17, CCPA, and other regulations be ensured | Regulatory Compliance |

| How long will technical support be required for the migrated policy records | Cost & Production Stability |

A Unique Migration Framework Built for Insurance

Legacy policy, claims, billing, pricing, and exposure systems usually have obsolete technology stack and need special consideration to transform to new systems.

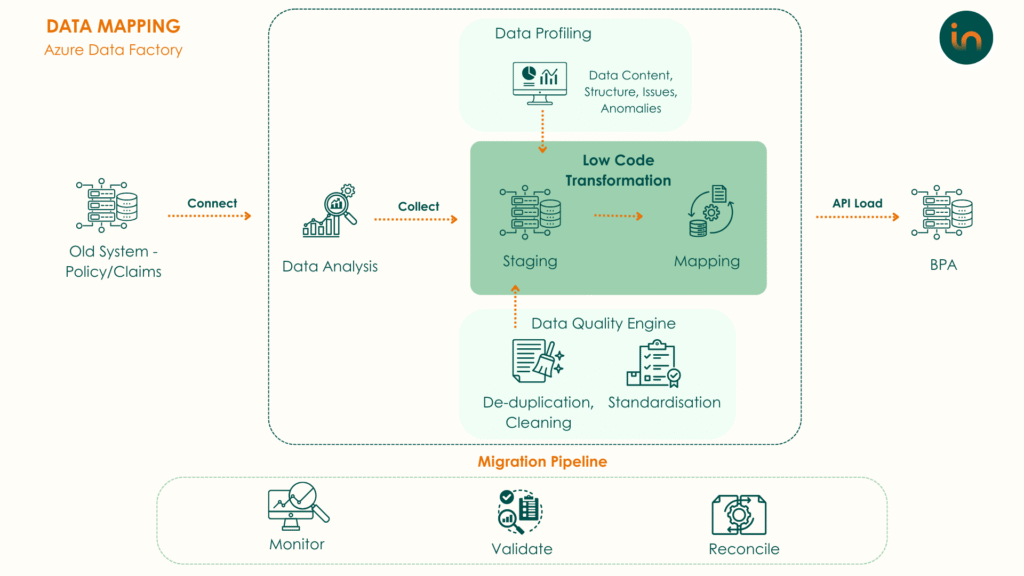

Unlike conventional ETL tools, ChainThat migration framework powered by Azure Data Factory (ADF) provides insurance organisations with:

| API-First Approach | No direct database-to-database data push, using API interfaces instead |

| Advanced Data Transformation | Built-in capabilities for cleansing and mapping with minimal code |

| Comprehensive Data Quality Engine | De-duplication, cleaning, and standardisation |

| Low-Code Transformation | Simplifies complex data mapping operations |

| Complete Migration Pipeline | Connect → Collect → Transform → Load with continuous monitoring |

| Third-Party Integration | Connects to external services for specialised transformations |

| Automated Workflows | Scheduling and triggering reduce manual intervention |

| Scalable Architecture | On-demand compute resources handle fluctuating workloads |

| Real-Time Monitoring | Integrated dashboards track pipeline performance and errors |

| Enterprise Security | Encryption and compliance with SOC2, GDPR, and CCPA standards |

Making Migration Easy and Reliable

ChainThat has innovated an agile business-focused policy life cycle migration framework that eliminates the risks of traditional migrations from legacy systems. Instead of outdated Extract, Transform, Load (ETL) methods, our approach is Low code configuration dependent, API-driven, AI-augmented, and built with ADF for automation and scalability.

Our approach is more business driven with an advanced technology underneath to support that

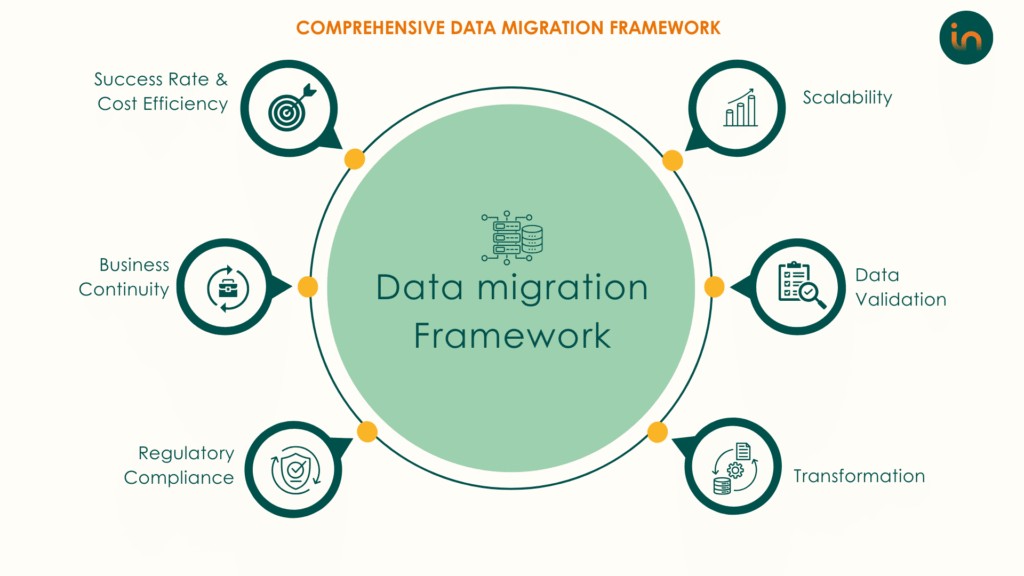

Ensuring Highest Business Continuity

- Operations can start using new system from Day1 post migration

- Negligible business downtime, ChainThat framework maintains seamless operations

- Eliminates manual intervention through automation

- ChainThat’s framework reduces migration from weeks to days

- Instant rollback mechanisms ensure data integrity

Automated Data Validation and Cleansing

- Pre-migration anomaly detection ensures clean, accurate data

- JSON-based validation models guarantee auditability and compliance

- API-based transformation ensures only relevant data migrates

Support Regulatory Needs

- Integrates with GDPR, IFRS 17, CCPA requirements, reducing regulatory risk

- SOC2-compliant framework enhances security, encryption, and cybersecurity

- Full audit logs ensure traceability and compliance reporting

Supports Next-Level Transformations

- Transforms data between industry standards during migration

- Integrates new business products while transforming existing data without manual intervention

- Enables business with data/report to perform actuarial analysis supporting rate filing, so that insurers can compare rates and file easily to required US states

Highest Success Rate, Low Operational Cost

- Achieves over 99% success rate

- Robust retry mechanism leaves only legitimate business failures

- Minimises post-go-live support needs, reducing operational costs

Robust & Scalable

- Features error handling, failover strategies, and self-healing capabilities

- Handles datasets from small to millions of records with dynamic resource expansion

- Incorporates redundant systems and continuous monitoring

Real-World Impact: A Success Story

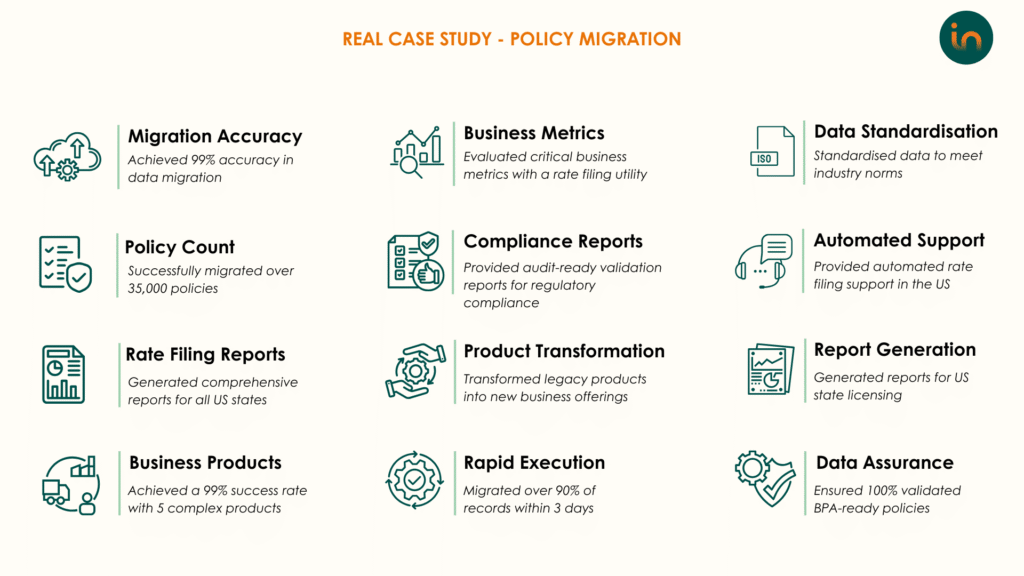

A leading US farm mutual insurer faced significant challenges in converting the policies from current system into a modernising policy administration system of BPA. The risks included data loss, system downtime, and compliance hurdles. ChainThat’s policy migration framework, powered by ADF, enabled them to achieve this in an easy & secure manner with number of business benefits as listed below.

The Big Bang Approach to Policy Data Migration

When migrating policy data, insurers have several options: an incremental approach, migration based on policy renewal dates, or a complete transition in one go—each with its own advantages and challenges.

After careful evaluation, we opted for a Big Bang approach, migrating all existing policies at once to the new BPA system. The key factors influencing this decision were:

- Operational Complexity – Maintaining two systems simultaneously posed significant operational challenges.

- User Experience – Underwriters and Agents would have faced confusion navigating between two systems based on policies.

- Cost Efficiency – Running dual systems meant higher licensing & support costs.

- System Integration – The Insurer’s accounting system is tightly integrated with BPA, and BPA-generated events feed into regulatory, management, and financial reporting.

- Incremental Migration Challenges – A phased approach would introduce complexities related to modifications and endorsements of already migrated policies.

- Seamless management of upcoming renewals and endorsements – with the Big Bang approach, all policies have a clearly defined future workflow path as per BPA, eliminating any confusion or complications using the legacy system

By adopting the Big Bang approach, we aimed for a streamlined transition, minimising disruption and ensuring a seamless operational shift.

Client success at a glance:

The Future of Insurance Policy Migration

ChainThat is revolutionising the data migration landscape for insurers by integrating cutting-edge AI capabilities into its framework. In 2025, our upcoming AI-driven predictive models will analyse historical and real-time data to forecast potential migration challenges, enabling proactive issue resolution before they escalate into critical failures. This advanced intelligence minimises downtime and ensures data integrity throughout the migration process.

For CXOs in the insurance industry, ChainThat’s enhanced migration solution not only mitigates risks but also transforms data migration into a strategic business enabler.

Is Your Organisation Ready for a Painless Migration?

At ChainThat, we don’t just migrate data—we drive agility, efficiency, and compliance. Ready for a seamless migration? Let’s make it happen. Connect with us today at: info@chain.local

Authors: Jai Prakash Jhankal (AVP – Implementation) & Manish Kumar (Technical Architect) at ChainThat