Beyond Multinational Programs

BMNP activates agility in multinational insurance programs, seamlessly connecting your global network to streamline operations, ensure local compliance, and drive growth — all through our enterprise-grade platform built by industry insiders to save time and boost profitability.

We Go Beyond

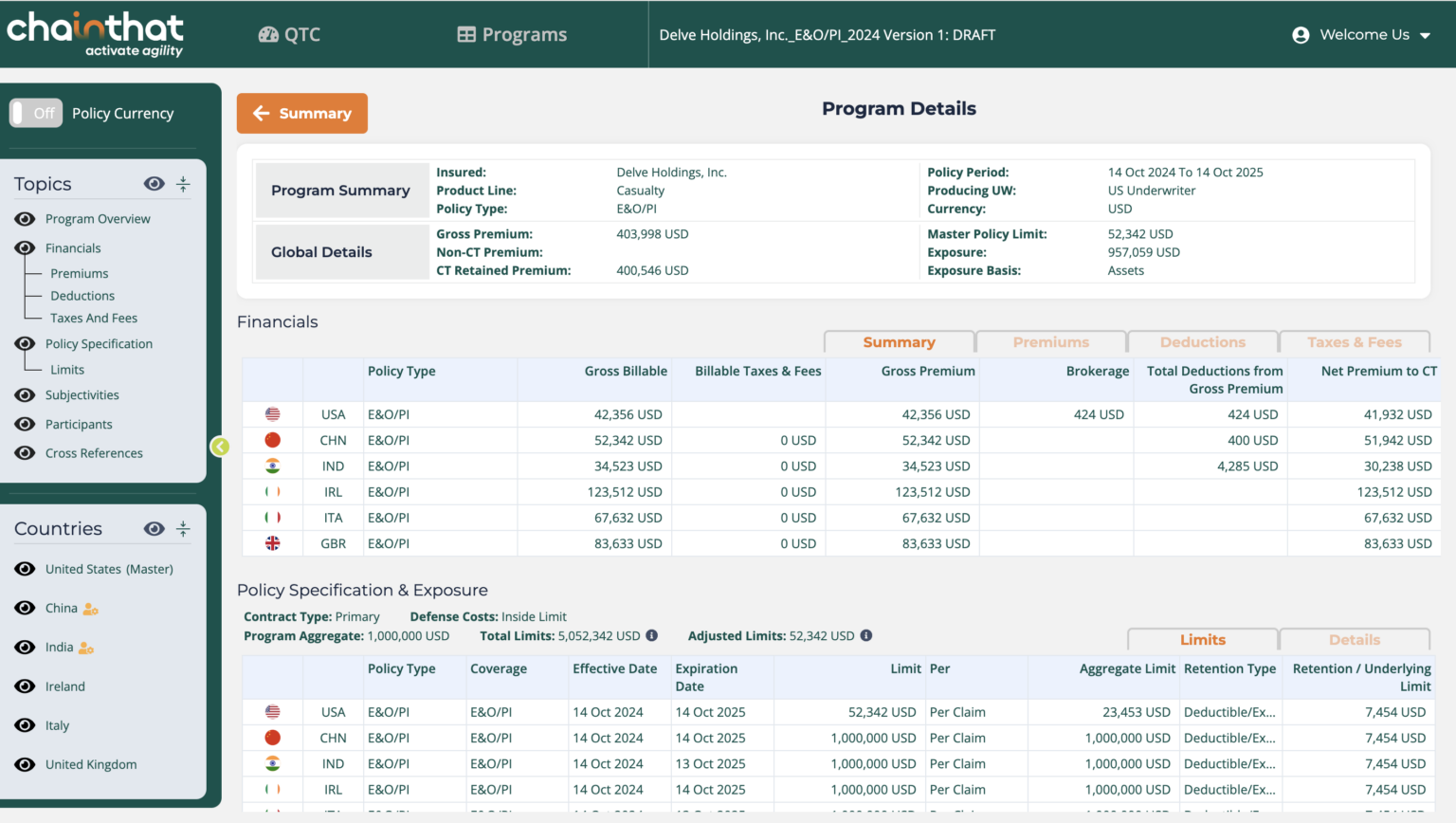

Our platform for multinational policy administration -BMNP – is beyond the average. In adopting BMNP, insurers gain simplicity, efficiency and transparency, as well as the agility to quickly adapt to new regulatory requirements across jurisdictions.

~30%

Reduction in operational costs

0

Manual rekeying during renewals. Global risk exposure and premiums copied over seamlessly

130+

Countries where platform is being used to place a multinational program.

1

Source of truth for informed decision-making

Product Architecture

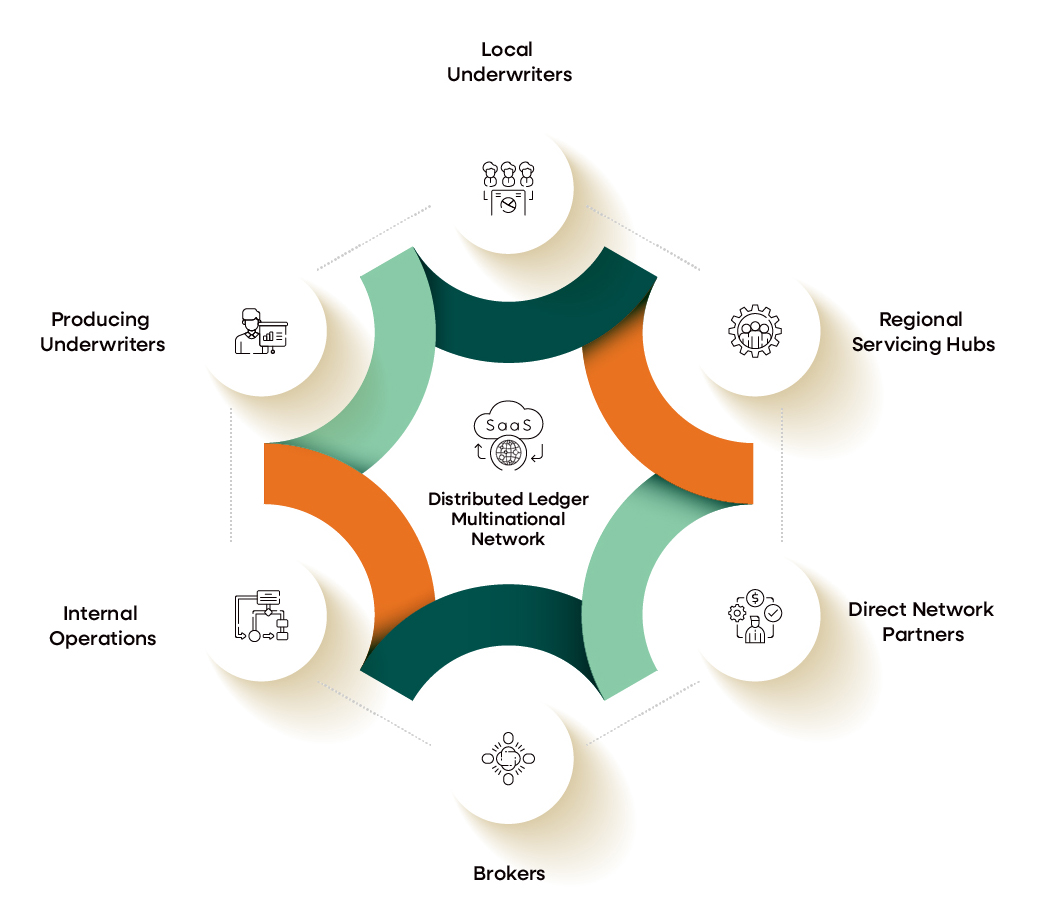

ChainThat’s Beyond Policy Administration Platform technology architecture leverages cloud-native container technology and a SaaS model with robust security, API-driven integration, and flexible access to ensure scalability, seamless integration, and comprehensive business insights.

-

DLT / Blockchain

Distributed Ledger Technology enables single source of truth and contact certainty between the parties.

-

Cloud Agnostic, SaaS-Enabled

BMNP’s cloud-native architecture provides hosting flexibility.

-

Microservices architecture

To facilitate responsive workflows and processes, scalability and agility.

-

Rich APIs

A comprehensive set of secure REST APIs makes integrations easy.

-

Role Based Access Control

BMNP employs a comprehensive authentication and authorisation framework to promote and ensure security.

-

Intuitive User Interface

BMNP uses a reactive and simple-to-use interface for users to get up and running quickly.

Working with ChainThat

We have a clear purpose at ChainThat to develop technology platforms that activate agility in insurance organisations, enabling them to realise their full business potential. Our dedicated team work hard to help our clients drive their competitive advantage and gain market share.

Berkshire Hathaway Specialty Insurance (BHSI) collaborates with ChainThat

“ChainThat’s distributed ledger-centric platform supports consistency, compliance, and transparency in our multinational transactions, … It enables BHSI to seamlessly coordinate and collaborate across local underwriters, producing offices, and network partners, facilitating the execution of our multinational programs”. – Head of Multinational at BHSI

Berkshire Hathaway Specialty Insurance (BHSI) collaborates with ChainThat

“ChainThat’s distributed ledger-centric platform supports consistency, compliance, and transparency in our multinational transactions, … It enables BHSI to seamlessly coordinate and collaborate across local underwriters, producing offices, and network partners, facilitating the execution of our multinational programs”. – Head of Multinational at BHSI