Beyond Insurance Accounting

Beyond Insurance Accounting (BIA) redefines the financial operations landscape with an industry-specific accounting platform that unifies billing, payments, and accounting into a compliant, automated solution. Built to deliver real-time control, strategic insights, and scalability, BIA empowers insurance organisations like MGAs, agencies, carriers, and brokers to operate with precision and confidence in an ever-evolving market.

A True Partner

We Go Beyond

Our newest platform – BIA – revolutionises insurance accounting by automating the source-to-ledger process. With AI-powered data ingestion, low-code rule mapping, and automated reconciliation workflows, BIA provides accurate, audit-ready financials in real time. This next-generation cloud-native platform offers CFOs and finance leaders the ability to pivot from reactive reporting to strategic decision-making, all while maintaining compliance and minimising operational overhead.

Operational Excellence

Eliminate inefficiencies caused by manual processes and disjointed systems. BIA automates real-time period-end financial operations to reduce reconciliation errors and ensure compliance. This leads to faster closes and reliable financial data that auditors and regulators can trust.

Strategic Focus

Free your finance team from routine tasks so they can concentrate on higher-value initiatives like analysis, planning, and credit control monitoring. By automating repetitive processes, BIA allows your team to focus on driving profitability and strategic growth.

Ecosystem Integration

Connect seamlessly with existing insurance systems, ensuring a unified financial control layer across your entire value chain. BIA’s integration-first design allows for rapid deployment without disrupting your current workflows or requiring extensive IT overhauls.

Future-Proof Foundation

Built to adapt to regulatory changes and market demands, BIA evolves with your organisation’s needs. Its scalable, cloud-native architecture guarantees it remains a valuable, enduring part of your accounting infrastructure.

Your Key Benefits

Clear. Controlled. Connected.

Functional Capabilities

BIA offers a robust suite of modules designed to meet the unique challenges of insurance finance:

- Product Configuration

- Underwriting & Rating

- Policy lifecycle

- Reporting & Integration

- Forms & Billing

- Migration

Product Configuration

Product set-up

Configure Insurance Product: Product structure, underwriting rules, forms, portals, notifications multi-carrier support, multi-currency support, broker management, commission handling, AI-assisted configuration, taxes and regulatory compliance. Verified by Kentucky Department of Insurance for handling taxes

Self-service configuration

BPA’s no-code configuration tool means that insurers are able to establish their system on their own. The Gen AI-assisted configuration helper empowers insurers to autonomously customize and deploy insurance products through an intuitive, conversational interface

Product Versioning

BPA maintains a comprehensive version control system for all insurance products with configurable approval process of product roll outs, ensuring traceability and auditability throughout the product lifecycle.

Product Templates

Pre-configured accelerators, containing common policy structures, coverages, and rules that can be rapidly customized for new product launches across different lines of business or geographical regions, promoting operational efficiency

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Underwriting / Rating

Automate Underwriting Rules

Predefined decision-making configurations that evaluate insurance applications based on specific criteria, enabling faster and more consistent risk assessment. Such automated UW rules can be easily updated to reflect changes in underwriting guidelines, market conditions, or regulatory requirements, ensuring agility in product management.

Rating engine

Inbuilt rating engine that can handle multi-section, multi-product rating for bundled offerings. With drag-drop capability & rule based configuration, it allows rating administrators to define, modify and manage rating rules with multiple versions with specific effective dates. Gain greater control and visibility with BPA’s built-in rating engine equipped with configurable rate tables and version control.

Work with external rater

BPA can seamlessly integrate with external rating services through APIs, allowing insurers to leverage standardized, up-to-date rating content and algorithms within their existing workflows, enhancing pricing accuracy and operational efficiency. It can integrate with Verisk’s ISO RaaS (Rating as a Service).

Audit history / versions

Obtain greater transparency with dynamically generated rating worksheet and maintain detailed logs of all rating calculations, supporting transparency, debugging, and regulatory compliance.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Policy Lifecycle

End-to-end policy servicing

BPA systems provide comprehensive support for the entire policy lifecycle, from quoting and issuance through renewals and cancellations, binder management, while accommodating out-of-sequence endorsements to ensure accurate policy servicing and maintain historical integrity.

Flexible Workflows

BPA systems orchestrate comprehensive underwriting workflows, automating risk assessment, decision-making and approval processes from initial application through policy issuance and post-bind transactions. Dynamic OFAC check can be integrated at different points in the workflow.

Task Management

BPA platforms offer robust task management capabilities, including automated and manual task creation, allocation to individuals or groups, SLA tracking and escalation, and flexible workflow design to support diverse business processes and operational efficiency.

Insurer/Broker/Insured Portals

BPA offers intuitive, drag-and-drop tools for rapidly building user-friendly portals tailored to underwriters, brokers, and insureds, enabling easy customisation of look-and-feel, user journeys, and functionalities.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Reporting / Integration

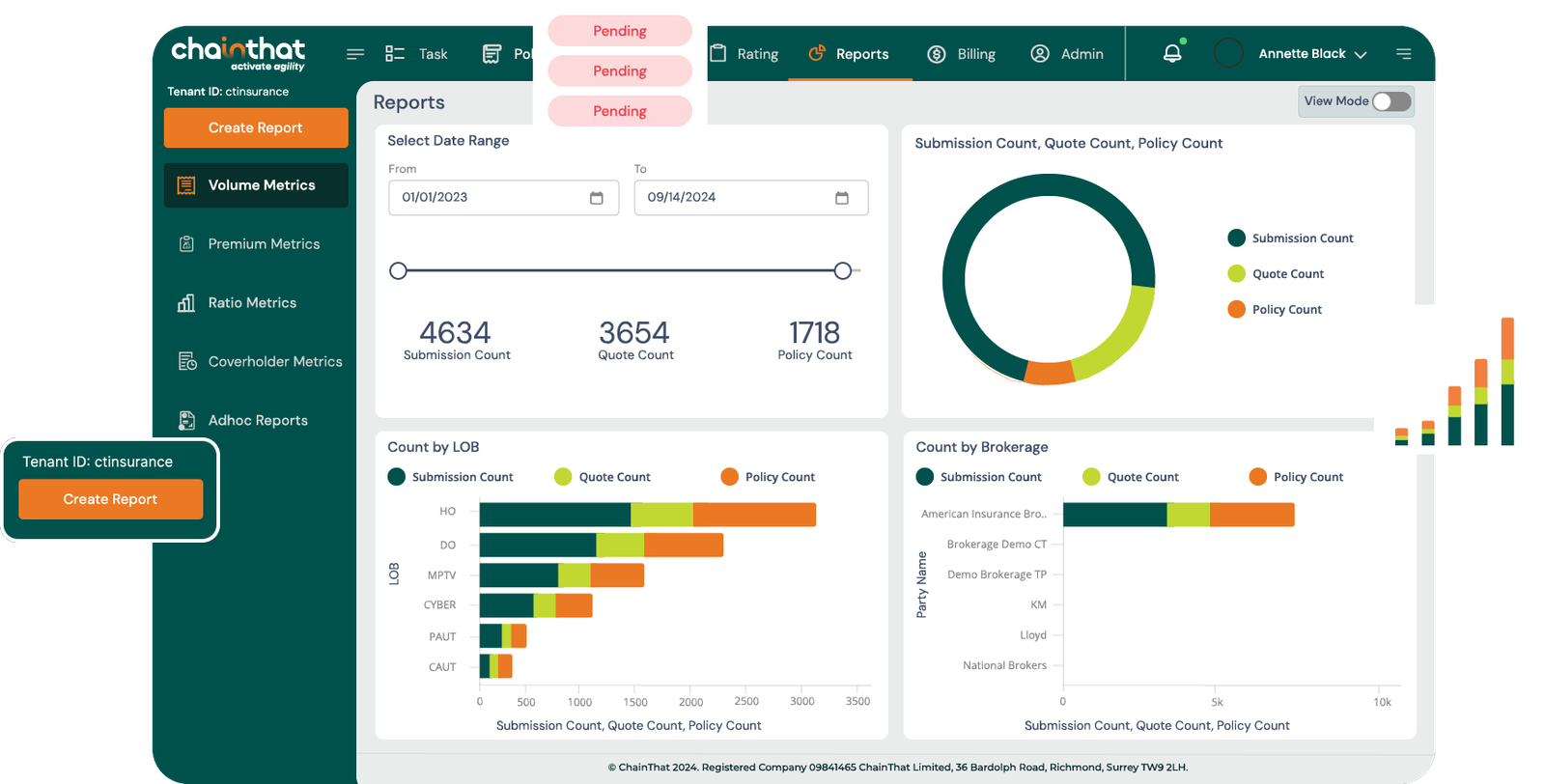

Embedded Analytics

Ensure transparency and monitor business performance accurately with real-time reporting and business intelligence tools in BPA. Supports Lloyds’ 5.2 Borderaux report for coverholders.

Role Based Access Control

Working on role-based access rules as standard, BPA adds an extra layer of security with SSO and multi-factor authentication tools. BPA has robust Role Based Access Control to configure fine grained user authorisations on the platform.

Data Connectors

BPA comes with more than 30 pre-built out-of-the-box connectors that seamlessly integrate with various data sources and third-party systems. BPA can easily connect with heterogeneous systems with various integration protocols (SOAP, REST, Webhook etc.)

Headless architecture

BPA platforms leverage headless architecture to provide flexible, API-driven integration capabilities, enabling seamless connection with diverse third-party systems while maintaining a robust, scalable core that supports omnichannel experiences. BPA publishes all its APIs as Open API specifications.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Billing & Forms

Payment Plans & Billing Options

Supports both direct and agency billing and ability to set-up and manage different payment plans and flexible commission handling. Configure the options based on the needs of the insurer.

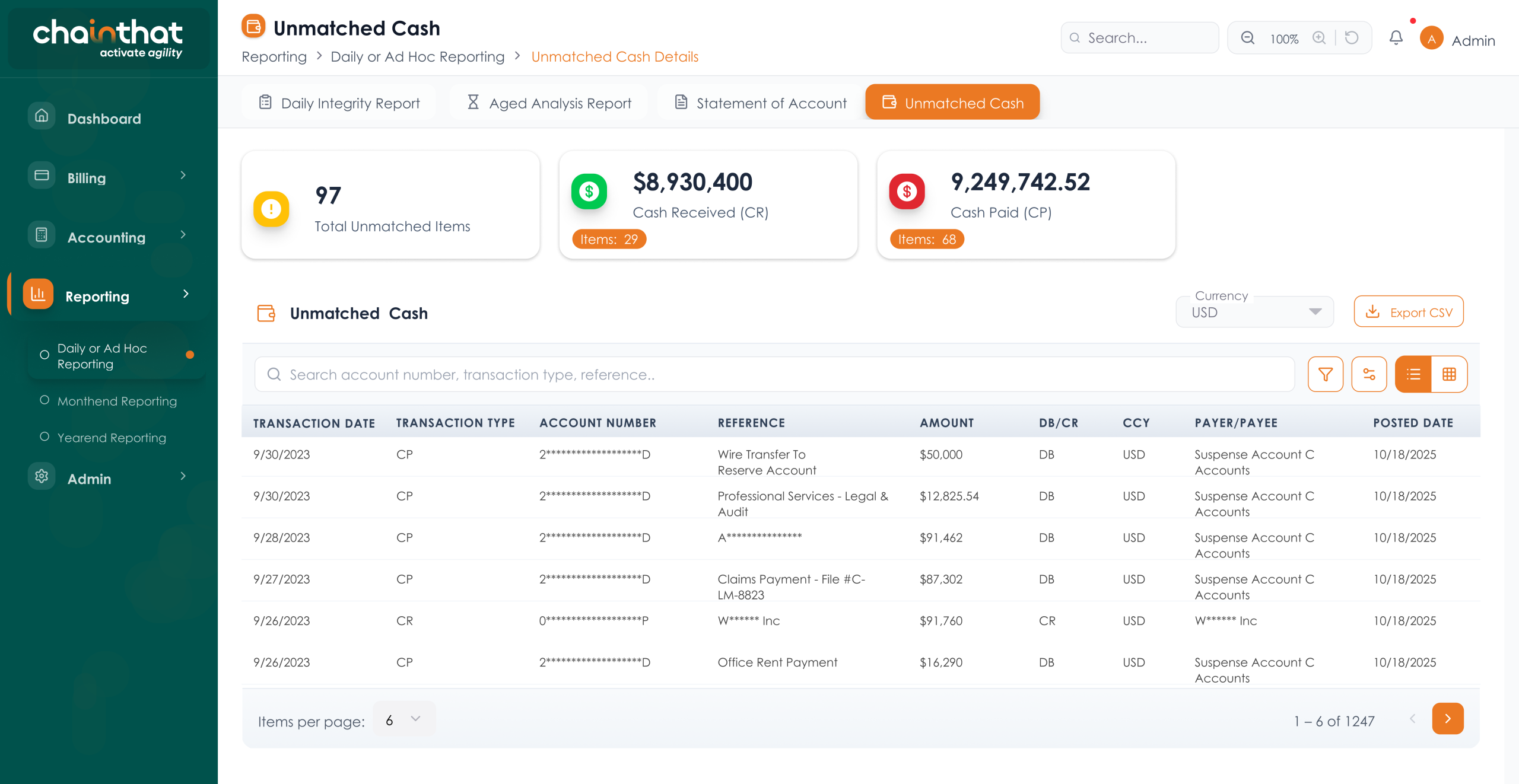

Cash Reconciliation

Cash Reconciliation Plugin helps insurers and MGAs automate broker remittance, internal policy records, and cash reconciliation between bank statements. Insurance organizations can extract remittances in PDF format and match them with broker accounts to verify policy and accounts receivable details

Forms/Document Management

BPA systems offer comprehensive form management and document handling, featuring static/dynamic form generation, intelligent data capture, version control, and automated document routing, while supporting digital signatures and integration with content management systems for streamlined paperless operations. Supports ISO and AAIS form too.

Flexibility & agility

Multi-carrier, multi-currency operations easily supported in BPA. ChainThat also provides effective and efficient version management support.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Migration

Single Platform – Connect & Collect

BPA leverages Azure Data Factory as a unified platform to seamlessly connect to diverse data sources and collect information, streamlining the initial stages of data migration.

Low Code – Transform & Enrich

Utilizing Azure Data Factory's low-code interface, BPA enables intuitive data transformation and enrichment, allowing business users to define complex migration logic without extensive programming.

Data Reconciliation – Monitor & Validate

BPA has robust monitoring and validation tools to ensure data accuracy and completeness throughout the migration process, facilitating real-time reconciliation and error detection.

Graphical Interface to Manage Progress

The platform provides a user-friendly graphical interface powered by Azure Data Factory, offering visual representations of migration workflows, progress tracking, and intuitive management of the entire data transition lifecycle.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.