Beyond Multinational Programs

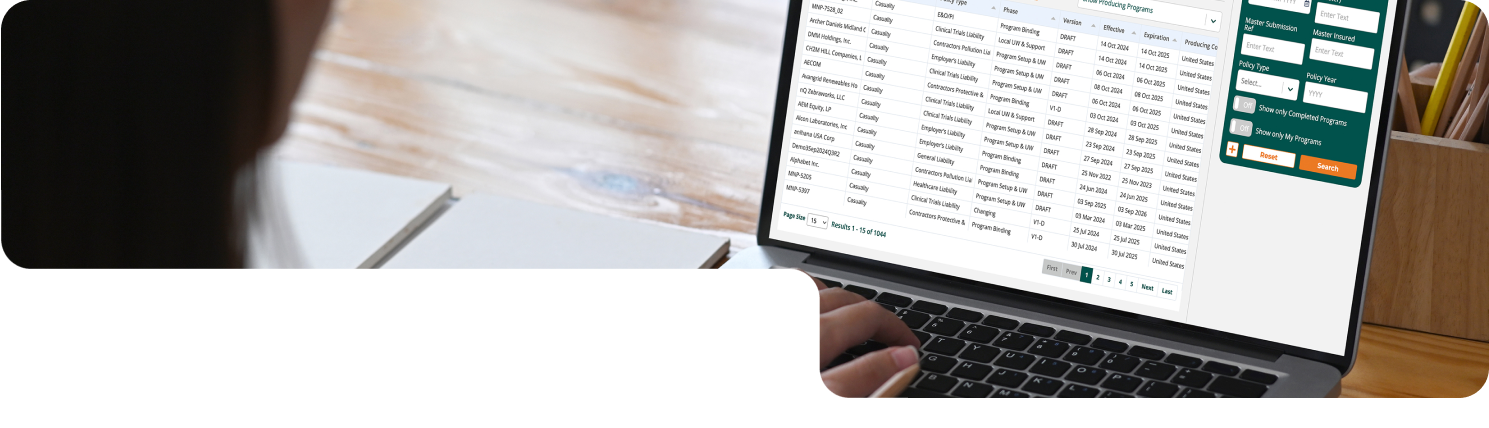

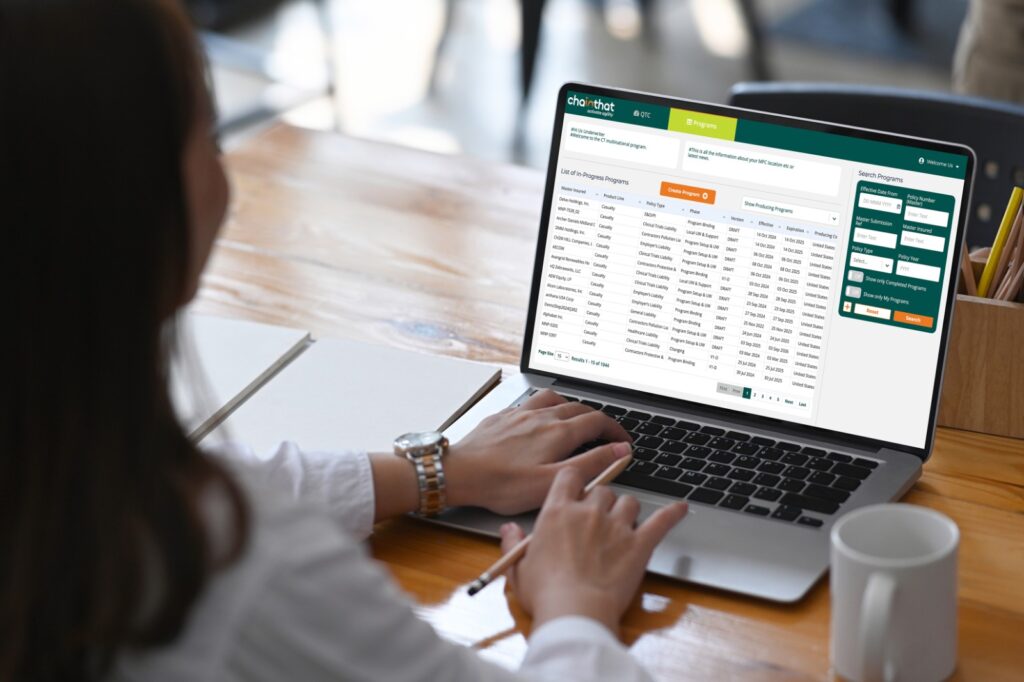

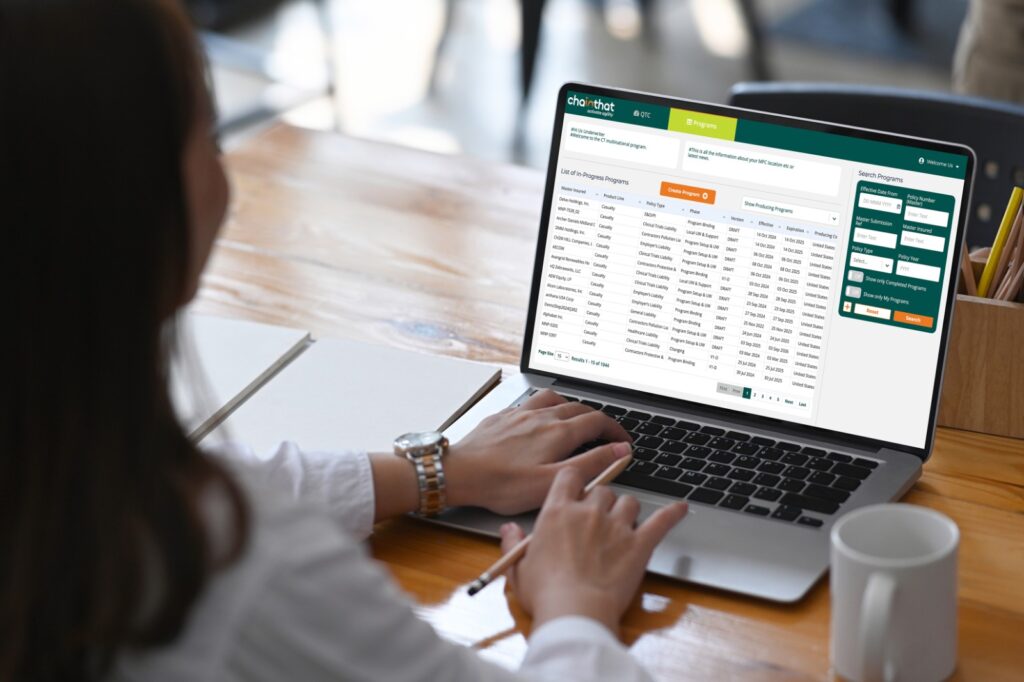

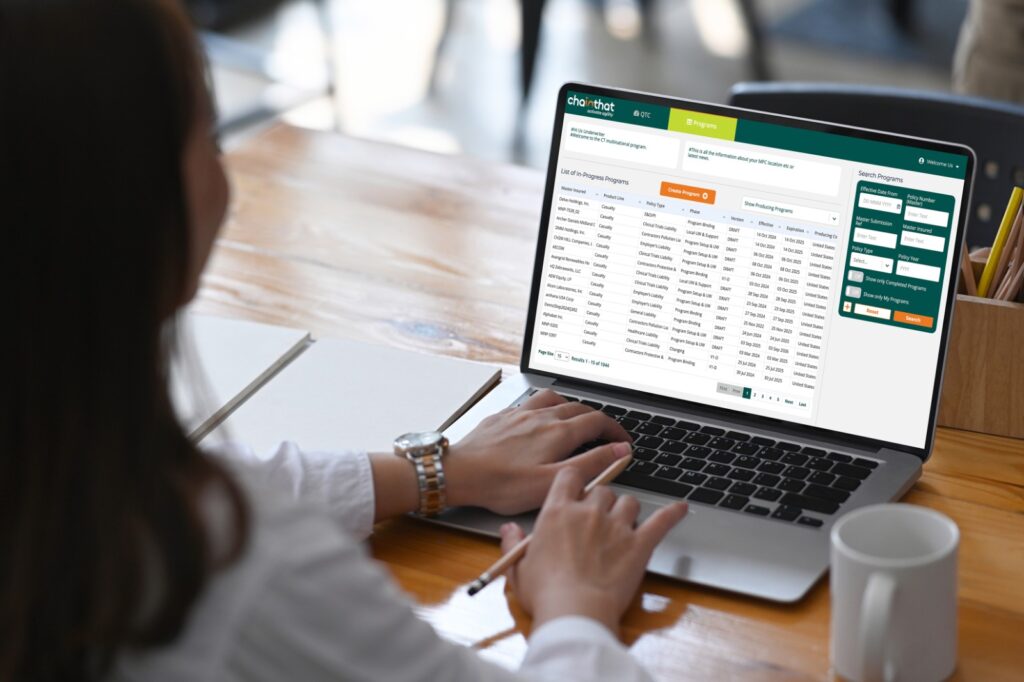

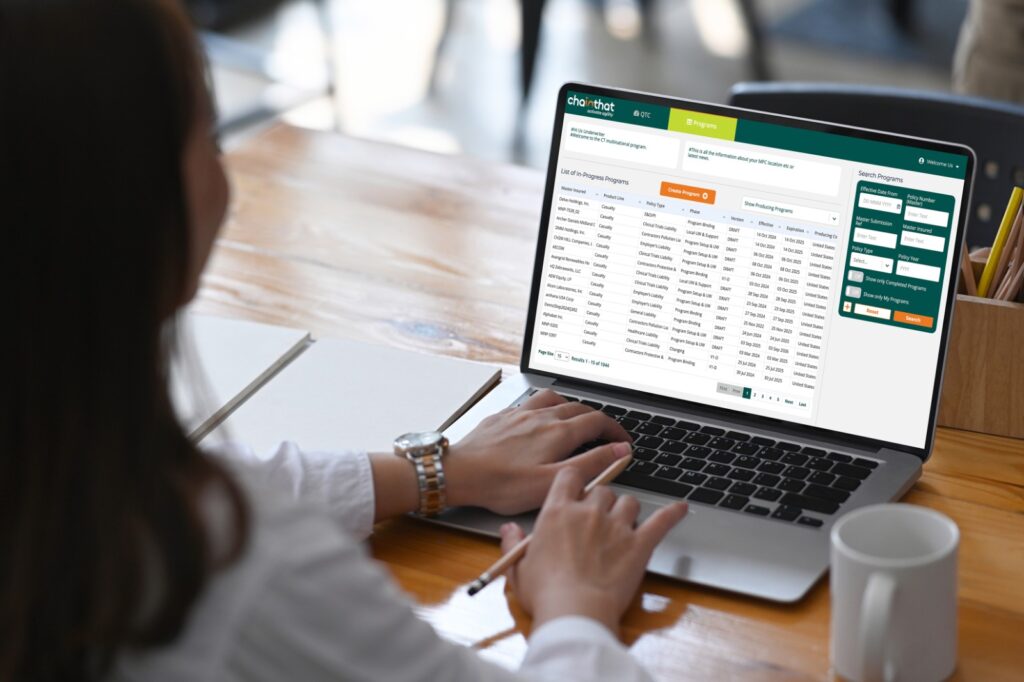

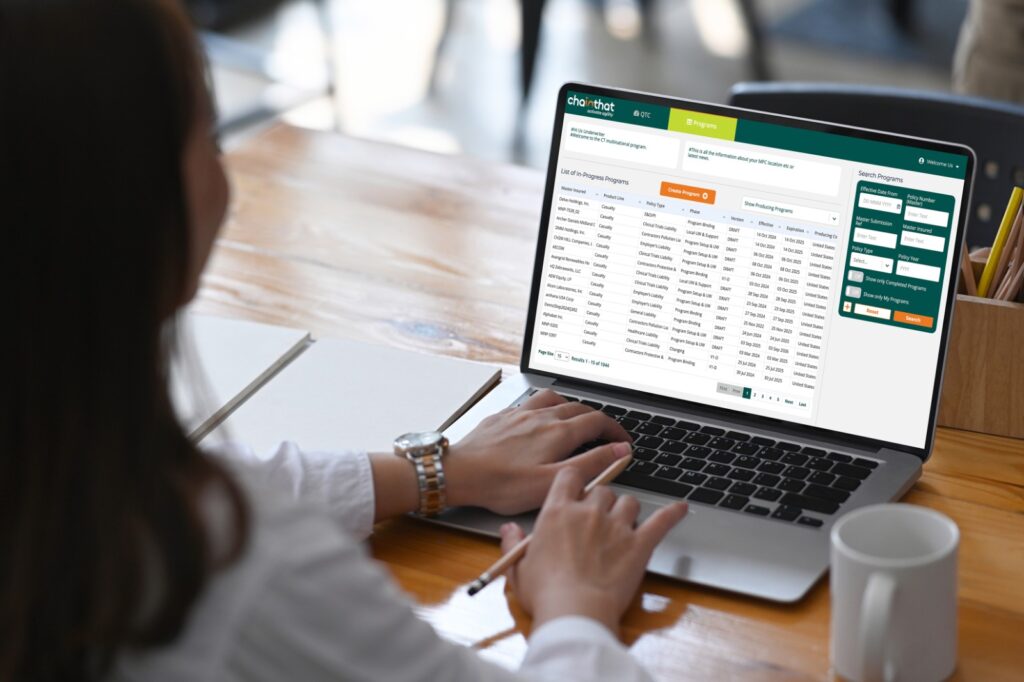

BMNP activates agility in multinational insurance programs, seamlessly connecting your global network to streamline operations, ensure local compliance, and drive growth — all through our enterprise-grade platform built by industry insiders to save time and boost profitability.

A True Partner

We Go Beyond

Our platform for multinational policy administration -BMNP – is beyond the average.

In adopting BMNP, insurers gain simplicity, efficiency and transparency,

as well as the agility to quickly adapt to new regulatory requirements across jurisdictions.

Lorem Ipsum dolar

sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Lorem ipsum dolor

Lorem ipsum dolor sit amet consectetur. Feugiat elementum neque massa pellentesque. Tristique sapien gravida arcu mauris molestie lectus.

Master Insurance Agility

Pain Relievers and Gain Creators

~30%

Reduction in operational costs

0

Manual rekeying during renewals. Global risk exposure and premiums copied over seamlessly

130+

Countries where platform is being used to place a multinational program.

1

Source of truth for informed decision-making

Functional Capabilities

What Beyond Multi National Programs delivers – in detail.

- Program Setup & Management

- Underwriting Intelligence

- Workflow & Task Management

- Partner Management & Communications

- Reporting & Integration

- Multinational Operations

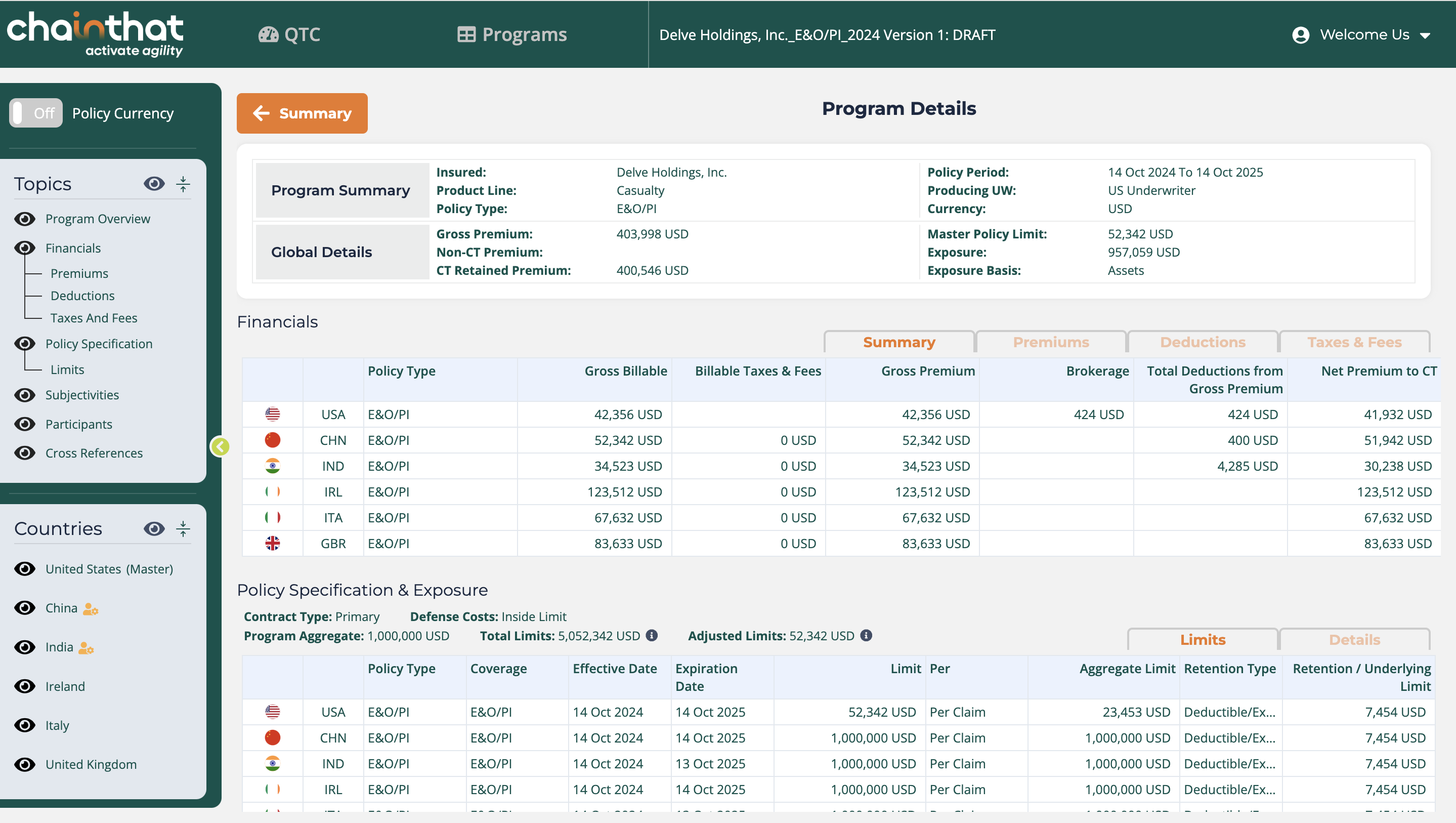

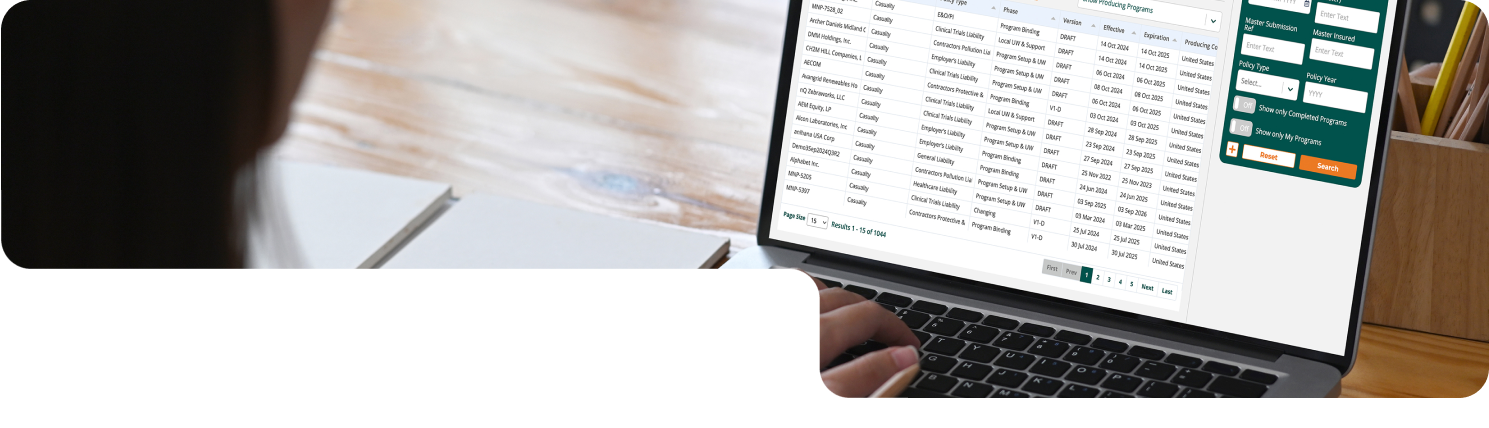

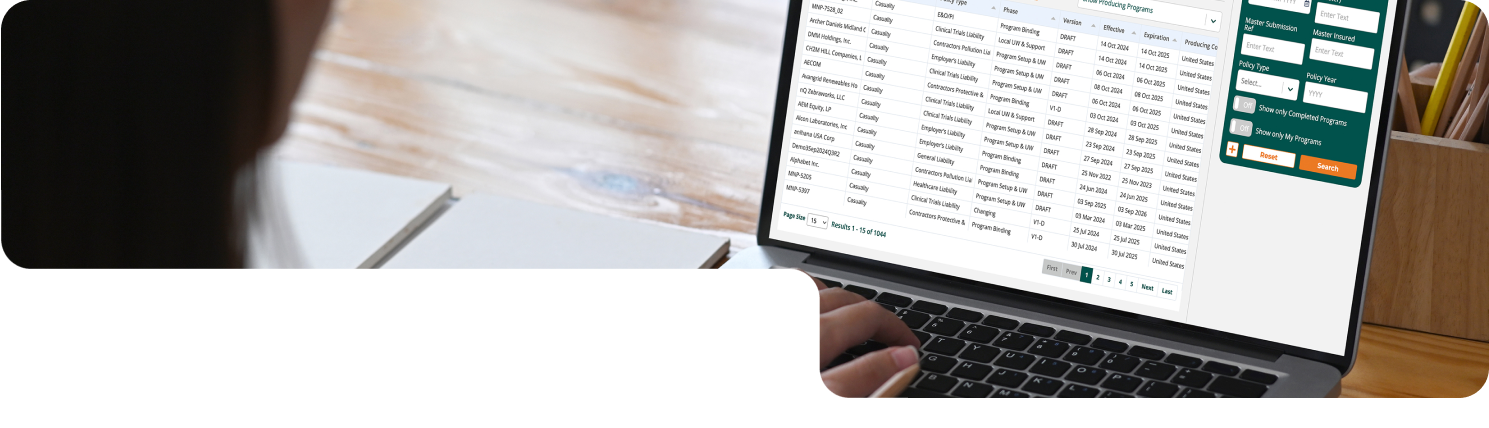

Program Setup & Management

Local/Master policy setup

Collect global risk information with both master and local policies, including financials and policy specifications, with capabilities for endorsements and renewals

Program Participants

Utilize BMNP’s intuitive set up process and manage all program participants, including internal teams, regional hubs, and external fronting partners

Underwriting intelligence

Integrate country-specific underwriting intelligence to guide users through local regulatory requirements and partner subjectivities

Policy Specifications

Support multiple policy types, currencies, and Freedom of Service (FOS) arrangements, rate of exchange with capabilities for endorsements and renewals

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Underwriting Intelligence

Country Intelligence

Enact various layers of rules, including country-specific regulations, local broker requirements, and partner-specific subjectivities.

Adaptive workflow

Ensure compliance at every step of the insurance lifecycle. Control the process by providing better clarity of next steps and actions to internal and external users of the platform.

Customizable rule sets

Configure intelligence rules for individual countries, direct network partners, and lines of business. BMNP provides the necessary flexibility and accuracy.

Audit all actions

Audit all actions on the platform to see data and process lineage across the insurance program.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Workflow & Task Management

Comprehensive process support

Efficiently manage end-to-end workflows including submission, clearance (KYC), local underwriting support, binding and issuance, reinsurance, and policy enforcement.

Intelligent task assignment

Make workflow simpler with BMNP’s ability to guide users with clearly sign-posted tasks for manual intervention and review, supporting multiple languages for global teams.

Automated reminders

Don’t miss a deadline. BMNP generates system alerts for time-sensitive tasks, ensuring timely completion of critical steps in the process.

Flexible task reassignment

Easily reallocate tasks between underwriters, promoting team collaboration and workload balancing.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Partner Management &

Communications

Seamless partner onboarding

Easily onboard and manage external partners, supporting flexible expansion of your global network.

Partner-specific requirements

Enforce partner-specific subjectivities and requirements, ensuring compliance with individual partner needs.

Real-time communication

Enable instant messaging between producing teams, regional underwriters, and partners for efficient collaboration.

Document generation & management

Generate multinational insurance addendums, coversheets, and RI slips. Manage documentation templates and share supporting documents securely.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Reporting & Integration

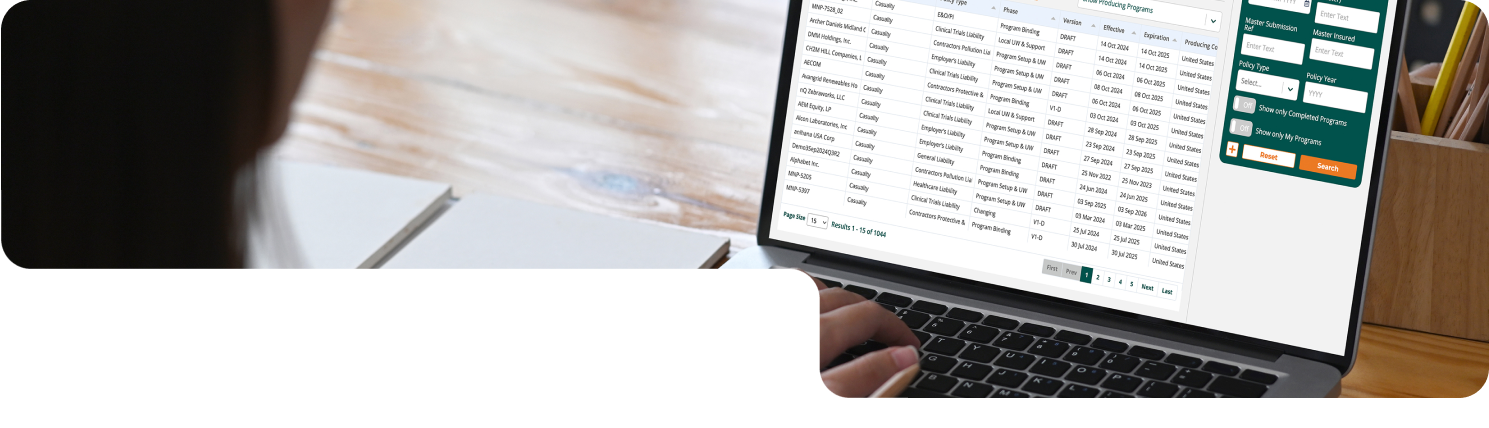

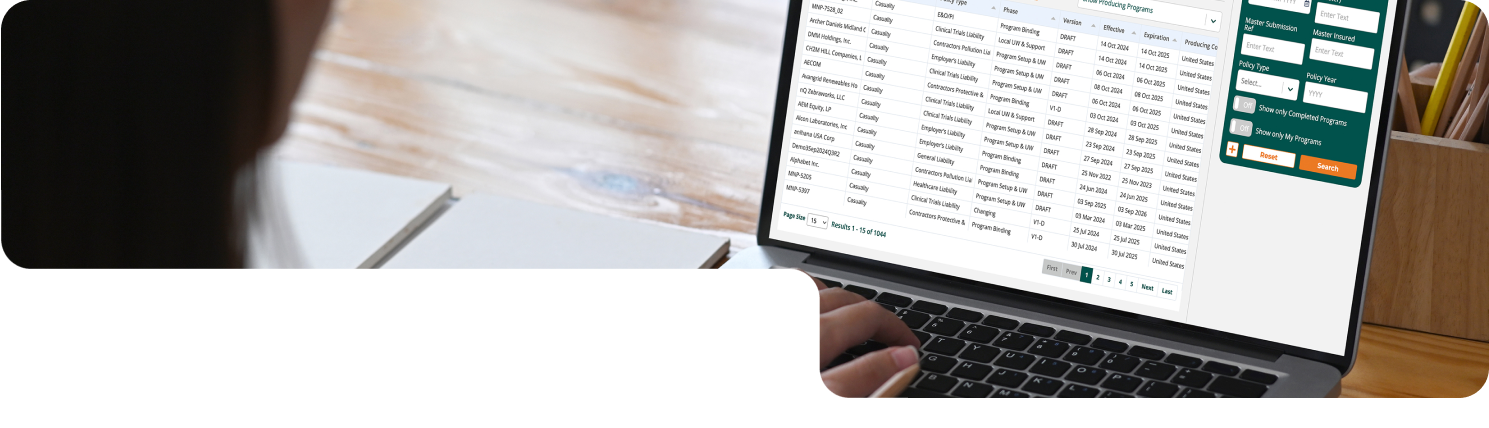

Real-time operational dashboard

View program statuses in real time for swift decision-making and proactive management.

Customizable reporting solution

Flexible, in-built reporting tools to generate program insights. Extract data in presentable formats for customers and brokers.

API-driven architecture

Achieve seamless integration with internal systems and external data sources, facilitating smooth data flow and process automation.

Comprehensive data dictionary

Utilize BMNP’s rich, detailed data dictionary that allows insurers to understand data relationships and streamline integrations.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Multinational Operations

Onboarding partner support

Make partner onboarding simple with KYC checks and CRM management tools that ensure new systems and processes integrate seamlessly.

Submission clearance

Simplify clearance requests across multiple countries with BMNP, and enable users to standardize submissions.

Multinational process support

BMNP’s Multinational Application effectively shares risk details and simplifies communication for all parties via a centralized portal updated and available in real-time.

Reinsurance handling

Make quick and well-informed decisions. BMNP gives partners the ability to see and access all risk details in real-time.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Program Setup & Management

Local/Master policy setup

Program Participants

Underwriting intelligence

Policy Specifications

Underwriting Intelligence

Country Intelligence

Adaptive workflow

Customizable rule sets

Audit all actions

Workflow & Task Management

Comprehensive process support

Intelligent task assignment

Automated reminders

Flexible task reassignment

Partner Management & Communications

Seamless partner onboarding

Partner-specific requirements

Real-time communication

Document generation & management

Reporting & Integration

Real-time operational dashboard

Customizable reporting solution

API-driven architecture

Comprehensive data dictionary

Multinational Operations

Onboarding partner support

Submission clearance

Multinational process support

Reinsurance handling

The Tech

Product Architecture

ChainThat’s Beyond Policy Administration Platform technology architecture leverages cloud-native container technology and a SaaS model with robust security, API-driven integration, and flexible access to ensure scalability, seamless integration, and comprehensive business insights.

DLT / Blockchain

Distributed Ledger Technology enables single source of truth and contact certainty between the parties.

Cloud Agnostic, SaaS-Enabled

BMNP’s cloud-native architecture provides hosting flexibility.

Microservices architecture

To facilitate responsive workflows and processes, scalability and agility.

Rich APIs

A comprehensive set of secure REST APIs makes integrations easy.

Role Based Access Control

BMNP employs a comprehensive authentication and authorisation framework to promote and ensure security.

Intuitive User Interface

BMNP uses a reactive and simple-to-use interface for users to get up and running quickly.

Working with ChainThat

We have a clear purpose at ChainThat to develop technology platforms

that activate agility in insurance organisations, enabling them to realise their full business potential.

Our dedicated team work hard to help our clients drive their competitive advantage and gain market share.

Berkshire Hathaway Specialty Insurance (BHSI) collaborates with ChainThat

“ChainThat’s distributed ledger-centric platform supports consistency, compliance, and transparency in our multinational transactions, … It enables BHSI to seamlessly coordinate and collaborate across local underwriters, producing offices, and network partners, facilitating the execution of our multinational programs”. – Head of Multinational at BHSIFIND OUT MORE

Berkshire Hathaway Specialty Insurance (BHSI) collaborates with ChainThat

“ChainThat’s distributed ledger-centric platform supports consistency, compliance, and transparency in our multinational transactions, … It enables BHSI to seamlessly coordinate and collaborate across local underwriters, producing offices, and network partners, facilitating the execution of our multinational programs”. – Head of Multinational at BHSI

BPA Implementation: Underwriting Agency

“Our partnership with ChainThat is more than just a business agreement. It’s a commitment to continually innovate to deliver better products and a more efficient quoting experience for our brokers.”