Beyond Policy Administration

Beyond Policy Administration (BPA) is our next-generation policy administration platform. A digital catalyst for growth, BPA fuses together product, distribution and capacity to help your business flourish. BPA provides customisable templates, flexible rule engine, configurable workflows and data-driven insights to save time and boost profitability.

A True Partner

We Go Beyond

By deploying BPA, insurers and MGAs gain simplicity and efficiency,

as well as the ability to quickly and smoothly launch new products and

adapt to new requirements as their businesses grow.

Lorem Ipsum dolar

sit amet

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Connectivity

System-integrated partner connectivity tools enhance collaboration, streamline data exchange, and create a cohesive ecosystem for internal and external stakeholders alike.

Governance

Straightforward governance framework tailored to the insurance sector, coupled with a centralized data approach for simpler decision-making via a single source of truth.

Fast & Flexible

Swiftly launch customised products using self-configuring templates and pre-built forms. Respond to market changes quickly with updatable pricing models.

Simplifies Underwriting

Optimise and streamline processes through BPA’s intuitive platform. The platform’s data-centric approach enhances risk assessment, reduces costs, and supports informed decision-making.

Customizable & Scalable

BPA’s tailored platform designed to grow with your business. Seamless scalability means the system can adapt easily to increasing demands.

Your Key Benefits

Master Insurance Agility

In Numbers

8-10

to launch a new product with BPA.

4

migrate 50K policy records.

30+

Pre-built data connectors.

~25%

Efficiency gained with

BPA’s GEN AI-assisted configuration.

Functional Capabilities

What Beyond Policy Administration delivers – in detail.

- Product Configuration

- Underwriting & Rating

- Policy lifecycle

- Reporting & Integration

- Forms & Billing

- Migration

Product Configuration

Product set-up

Configure Insurance Product: Product structure, underwriting rules, forms, portals, notifications multi-carrier support, multi-currency support, broker management, commission handling, AI-assisted configuration, taxes and regulatory compliance. Verified by Kentucky Department of Insurance for handling taxes

Self-service configuration

BPA’s no-code configuration tool means that insurers are able to establish their system on their own. The Gen AI-assisted configuration helper empowers insurers to autonomously customize and deploy insurance products through an intuitive, conversational interface

Product Versioning

BPA maintains a comprehensive version control system for all insurance products with configurable approval process of product roll outs, ensuring traceability and auditability throughout the product lifecycle.

Product Templates

Pre-configured accelerators, containing common policy structures, coverages, and rules that can be rapidly customized for new product launches across different lines of business or geographical regions, promoting operational efficiency

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Underwriting / Rating

Automate Underwriting Rules

Predefined decision-making configurations that evaluate insurance applications based on specific criteria, enabling faster and more consistent risk assessment. Such automated UW rules can be easily updated to reflect changes in underwriting guidelines, market conditions, or regulatory requirements, ensuring agility in product management.

Rating engine

Inbuilt rating engine that can handle multi-section, multi-product rating for bundled offerings. With drag-drop capability & rule based configuration, it allows rating administrators to define, modify and manage rating rules with multiple versions with specific effective dates. Gain greater control and visibility with BPA’s built-in rating engine equipped with configurable rate tables and version control.

Work with external rater

BPA can seamlessly integrate with external rating services through APIs, allowing insurers to leverage standardized, up-to-date rating content and algorithms within their existing workflows, enhancing pricing accuracy and operational efficiency. It can integrate with Verisk’s ISO RaaS (Rating as a Service).

Audit history / versions

Obtain greater transparency with dynamically generated rating worksheet and maintain detailed logs of all rating calculations, supporting transparency, debugging, and regulatory compliance.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Policy Lifecycle

End-to-end policy servicing

BPA systems provide comprehensive support for the entire policy lifecycle, from quoting and issuance through renewals and cancellations, binder management, while accommodating out-of-sequence endorsements to ensure accurate policy servicing and maintain historical integrity.

Flexible Workflows

BPA systems orchestrate comprehensive underwriting workflows, automating risk assessment, decision-making and approval processes from initial application through policy issuance and post-bind transactions. Dynamic OFAC check can be integrated at different points in the workflow.

Task Management

BPA platforms offer robust task management capabilities, including automated and manual task creation, allocation to individuals or groups, SLA tracking and escalation, and flexible workflow design to support diverse business processes and operational efficiency.

Insurer/Broker/Insured Portals

BPA offers intuitive, drag-and-drop tools for rapidly building user-friendly portals tailored to underwriters, brokers, and insureds, enabling easy customisation of look-and-feel, user journeys, and functionalities.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

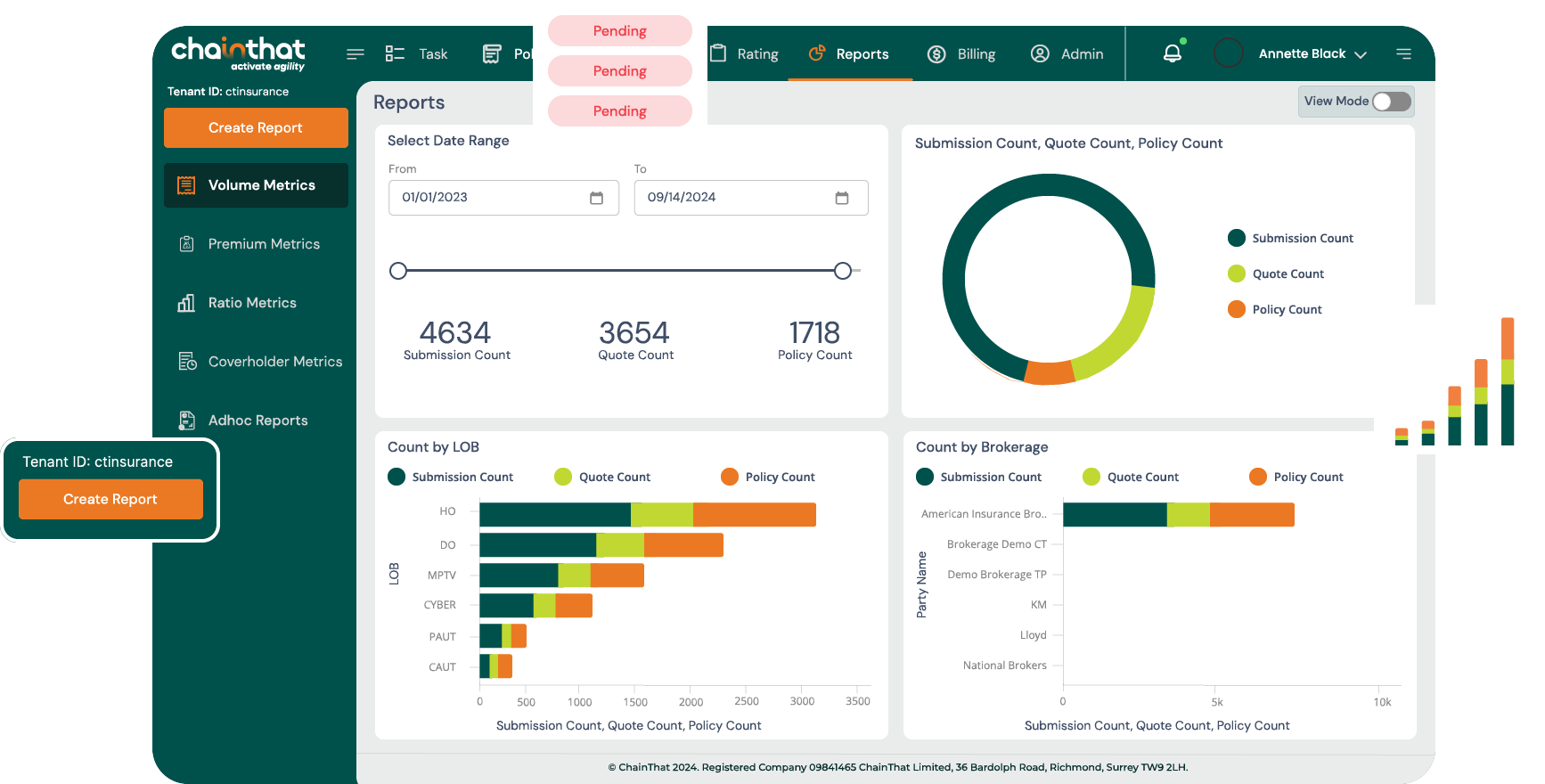

Reporting / Integration

Embedded Analytics

Ensure transparency and monitor business performance accurately with real-time reporting and business intelligence tools in BPA. Supports Lloyds’ 5.2 Borderaux report for coverholders.

Role Based Access Control

Working on role-based access rules as standard, BPA adds an extra layer of security with SSO and multi-factor authentication tools. BPA has robust Role Based Access Control to configure fine grained user authorisations on the platform.

Data Connectors

BPA comes with more than 30 pre-built out-of-the-box connectors that seamlessly integrate with various data sources and third-party systems. BPA can easily connect with heterogeneous systems with various integration protocols (SOAP, REST, Webhook etc.)

Headless architecture

BPA platforms leverage headless architecture to provide flexible, API-driven integration capabilities, enabling seamless connection with diverse third-party systems while maintaining a robust, scalable core that supports omnichannel experiences. BPA publishes all its APIs as Open API specifications.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Billing & Forms

Payment Plans & Billing Options

Supports both direct and agency billing and ability to set-up and manage different payment plans and flexible commission handling. Configure the options based on the needs of the insurer.

Cash Reconciliation

Cash Reconciliation Plugin helps insurers and MGAs automate broker remittance, internal policy records, and cash reconciliation between bank statements. Insurance organizations can extract remittances in PDF format and match them with broker accounts to verify policy and accounts receivable details

Forms/Document Management

BPA systems offer comprehensive form management and document handling, featuring static/dynamic form generation, intelligent data capture, version control, and automated document routing, while supporting digital signatures and integration with content management systems for streamlined paperless operations. Supports ISO and AAIS form too.

Flexibility & agility

Multi-carrier, multi-currency operations easily supported in BPA. ChainThat also provides effective and efficient version management support.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Migration

Single Platform – Connect & Collect

BPA leverages Azure Data Factory as a unified platform to seamlessly connect to diverse data sources and collect information, streamlining the initial stages of data migration.

Low Code – Transform & Enrich

Utilizing Azure Data Factory's low-code interface, BPA enables intuitive data transformation and enrichment, allowing business users to define complex migration logic without extensive programming.

Data Reconciliation – Monitor & Validate

BPA has robust monitoring and validation tools to ensure data accuracy and completeness throughout the migration process, facilitating real-time reconciliation and error detection.

Graphical Interface to Manage Progress

The platform provides a user-friendly graphical interface powered by Azure Data Factory, offering visual representations of migration workflows, progress tracking, and intuitive management of the entire data transition lifecycle.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Lorem ipsum dolor

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Policy lifecycle

End-to-end policy servicing

Flexible Workflows

Task Management

Insurer/Broker/Insured Portals

Reporting & Integration

Embedded Analytics

Role Based Access Control

Data Connectors

Headless architecture

Forms & Billing

Payment Plans & Billing Options

Cash Reconciliation

Forms/Document Management

Flexibility & agility

Migration

Single Platform – Connect & Collect

Low Code – Transform & Enrich

Data Reconciliation – Monitor & Validate

Graphical Interface to Manage Progress

Product Configuration

Product set-up

Self-service configuration

Product Versioning

Product Templates

Underwriting & Rating

Automate Underwriting Rules

Rating engine

Work with external rater

Audit history / versions

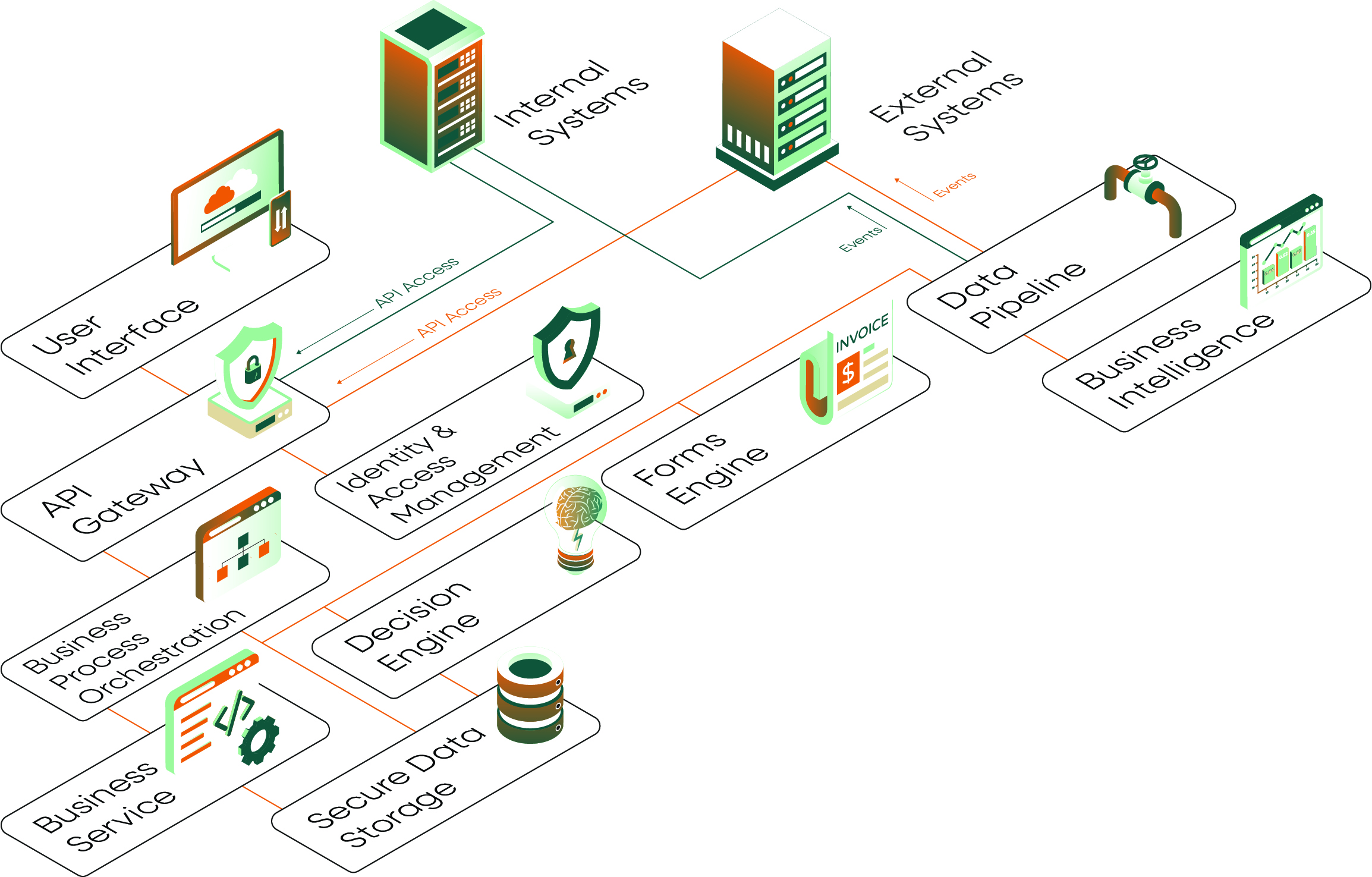

The Tech

Product Architecture

ChainThat’s Beyond Policy Administration Platform technology architecture leverages cloud-native container technology and a SaaS model with robust security, API-driven integration, and flexible access to ensure scalability, seamless integration, and comprehensive business insights.

Cloud-native and containerized

Utilizes cloud container technology for scalable and efficient deployment.

API-first and integration friendly

Designed with an API-first approach, BPA ensures seamless integration with various systems.

Microservices architecture

Supports a flexible and modular microservices architecture for enhanced scalability and maintenance.

Multi-tenancy support

Accommodates multiple tenants with data isolation and efficient resource usage.

Secure and compliant

Ensures data security with encryption at rest and in motion, adhering to the strictest compliance standards.

Automation and event-driven

Features automation testing capabilities and is built on an event-driven architecture for real-time processing.

Working with ChainThat

We have a clear purpose at ChainThat to develop technology platforms that activate agility in insurance organisations,

enabling them to realise their full business potential. Our dedicated team work hard to help

our clients drive their competitive advantage and gain market share.

Cyber Insurance – A Digital Revolution

“Enhancing operational efficiency and supporting scalable growth for an MGA that specializes in innovative cyber insurance products. Objectives included integrating advanced logic into workflows and enhancing process automation, reducing manual errors and facilitating seamless collaboration with a diverse range of partners.“. – Mike Cavanaugh, CUO of FusionFIND OUT MORE

Amparo Embraces Digital Capabilities Through ChainThat

“Amparo’s mission has always been to provide fair and accessible auto insurance to the immigrant community. Partnering with ChainThat allows us to leverage advanced technology to serve our customers better and streamline our processes.” – Pushan Sen Gupta Co-Founder of Amparo InsuranceFIND OUT MORE

Innovative Cyber Liability Offering launches using BPA

“With the ChainThat’s BPA platform, we can be in the driver’s seat of our products & distribution channels, enabling us to grow quickly and enhance our solutions over time”. – Mike Cavanaugh, CUO of Fusion

Amparo Embraces Digital Capabilities Through ChainThat

“Amparo’s mission has always been to provide fair and accessible auto insurance to the immigrant community. Partnering with ChainThat allows us to leverage advanced technology to serve our customers better and streamline our processes.” – Pushan Sen Gupta Co-Founder of Amparo Insurance